(Tax Update) Tax Identification Number (TIN) Search Service

With the rollout of e-invoicing in Malaysia, some business owners have faced challenges obtaining the Tax Identification Number (TIN) when issuing e-invoices. To address this, the Lembaga Hasil Dalam Negeri Malaysia (LHDNM) has introduced new initiatives to ensure a smooth transition for taxpayers.

What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique identification number assigned by LHDNM to individuals and businesses for tax purposes. It is used to track and manage tax obligations, ensuring compliance with Malaysia’s tax regulations. In the context of Malaysia, the TIN, also known as “Nombor Cukai Pendapatan” or Income Tax Number, is issued by the Inland Revenue Board of Malaysia (IRBM).

In Malaysia, individuals and entities registered as taxpayers with the IRBM are assigned a TIN. This number is crucial for tax compliance and financial transactions within the country. For Malaysian citizens, the TIN is typically issued once they reach the age of 18 years old.

In situations where individuals or entities do not have a TIN or fail to provide it for any reason, a functional equivalent may be used. In Malaysia, for individuals, the Malaysian National Registration Identity Card Number (NRIC Number) serves as a functional equivalent to the TIN. The NRIC Number is a unique 12-digit identifier issued to Malaysian citizens and permanent residents and is utilized by the IRBM for tax identification purposes.

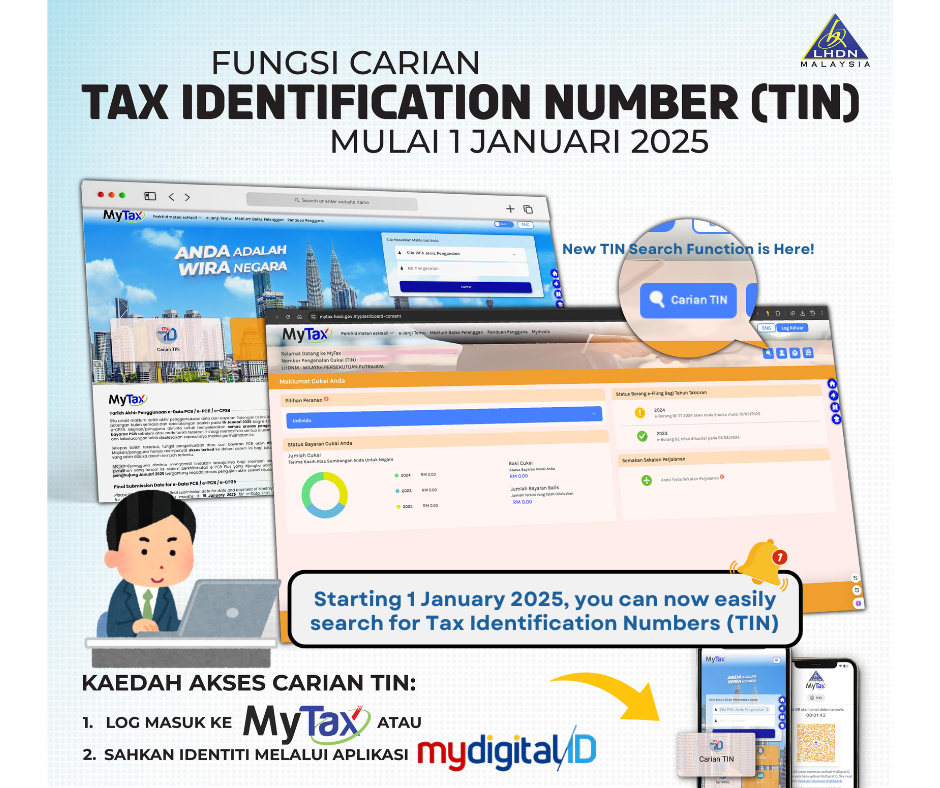

What’s New? Streamlined TIN Search Feature!

Starting 1 January 2025, searching for the TIN has never been easier, thanks to the new feature on the MyTax Portal!

📌 How to Search for TIN via MyTax Portal:

- Log in to your MyTax account.

- Use the “Carian TIN” function by scanning a QR code with the MyDigital ID App on your mobile device.

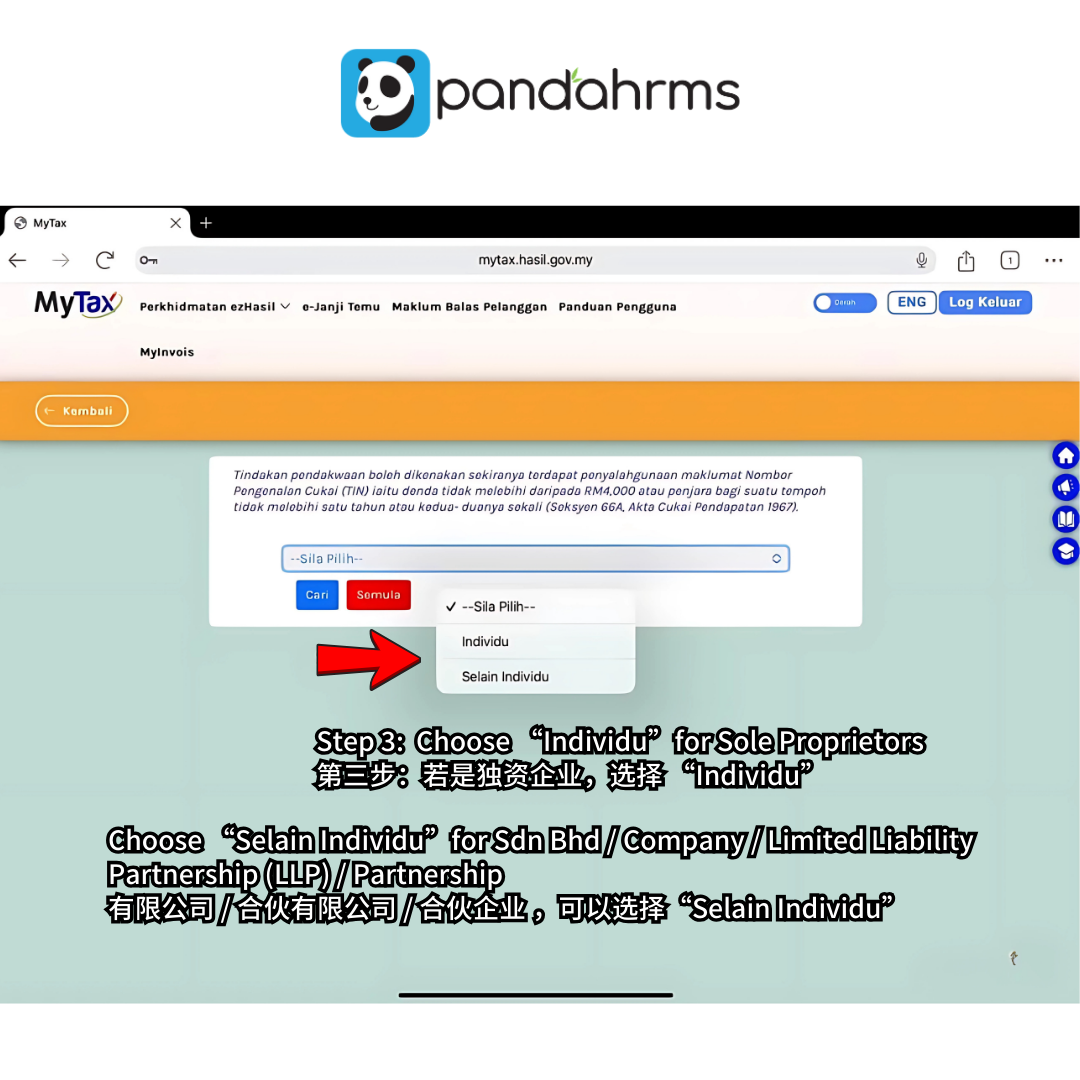

This new feature streamlines TIN retrieval for both individuals and business taxpayers:

✅ For Individuals – Search using Identity Card (IC) number or passport number.

✅ For Businesses – Search using Registration Number or company name.

📌 Integration with MyInvois and API

This new service integrates seamlessly with the MyInvois portal and Application Programming Interface (API), enabling businesses to prepare for the upcoming e-invoice implementation.

📌 Empowering Digital Identity:

Pair your tax management tools with MyDigital ID, Malaysia’s national digital identification platform. This secure and seamless system protects personal information while granting easy access to essential services, empowering users to transact confidently in the digital space.

Key Benefits:

💡 Easier Tax Compliance – Reduces administrative burdens for businesses and individuals, especially with e-invoice implementation.

💡 Stronger Security – Safeguards sensitive information through advanced digital identity verification.

💡 Accelerated Digital Transformation – Supports Malaysia’s shift towards a digitally empowered economy with secure and efficient tools.

Let’s adopt a smarter and more secure approach to managing taxes and digital identity! Businesses should take proactive steps to integrate their systems with LHDN’s platforms, ensuring they stay compliant and competitive in the evolving digital landscape.

These developments are driving Malaysia towards a more digitally advanced future, where convenience and security go hand in hand. With these innovative tools at our disposal, we can confidently embrace the digital era together.