Many Malaysian employers mistakenly believe that Borang E is only for companies with employees, but that’s not true! Even if your business has no employees, submission is still required to avoid penalties.

Every year, businesses in Malaysia must report employee income details to LHDN through Form E and CP8D. Understanding the process and requirements is essential to ensure compliance and prevent unnecessary fines.

This guide provides a step-by-step approach to submitting Form E and CP8D for 2025, ensuring you fulfill all compliance obligations under the Malaysia Employment Act efficiently and accurately.

What is Form E?

Form E, also known as Borang E, is a mandatory tax declaration form that all employers in Malaysia must submit annually to LHDN. It is used to report employee income details for the year and does not require any payment—it is purely for tax reporting purposes.

Many employers mistakenly believe that Form E is only required for businesses with employees, but this is not the case. Even if a company has no employees, submission is still mandatory to avoid penalties.

The deadline for submission is 31 March of the following year, and employers must file it electronically through the LHDN MyTax Portal via e-Filing.

What is CP8D?

CP8D is a supplementary document attached to Form E that provides a detailed breakdown of employee income and tax information. It includes salaries, bonuses, incentives, benefits, and other taxable remunerations. Additionally, it captures tax deductions such as PCB (Potongan Cukai Bulanan) contributions to help LHDN track employee earnings and tax compliance accurately. Employers must complete CP8D for every employee who worked for them during the tax year to ensure proper tax reporting.

Who Needs to Submit Borang E / CP8D?

All employers in Malaysia, including companies, businesses, and organizations, must submit Borang E and CP8D to LHDN. This requirement applies to:

✅ Private companies (Sdn Bhd)

✅ Public companies (Berhad)

✅ Partnerships & sole proprietorships

✅ Non-profit organizations & associations

Even if a company has no employees, it is still mandatory to file Borang E and declare “No Employees” to avoid penalties.

Deadline for Submission

The deadline for Borang E and CP8D submission depends on the filing method:

-

Manual submission (paper form): 28 February 2025

-

Online submission (e-Filing via MyTax Portal): 31 March 2025

Late submissions can result in penalties from LHDN, including fines and additional tax assessments.

How to Submit e-Data Praisi / e-CP8D

The first step in the submission process is to upload CP8D via e-Data Praisi. This method allows employers to submit employee tax data directly through the LHDN MyTax Portal.

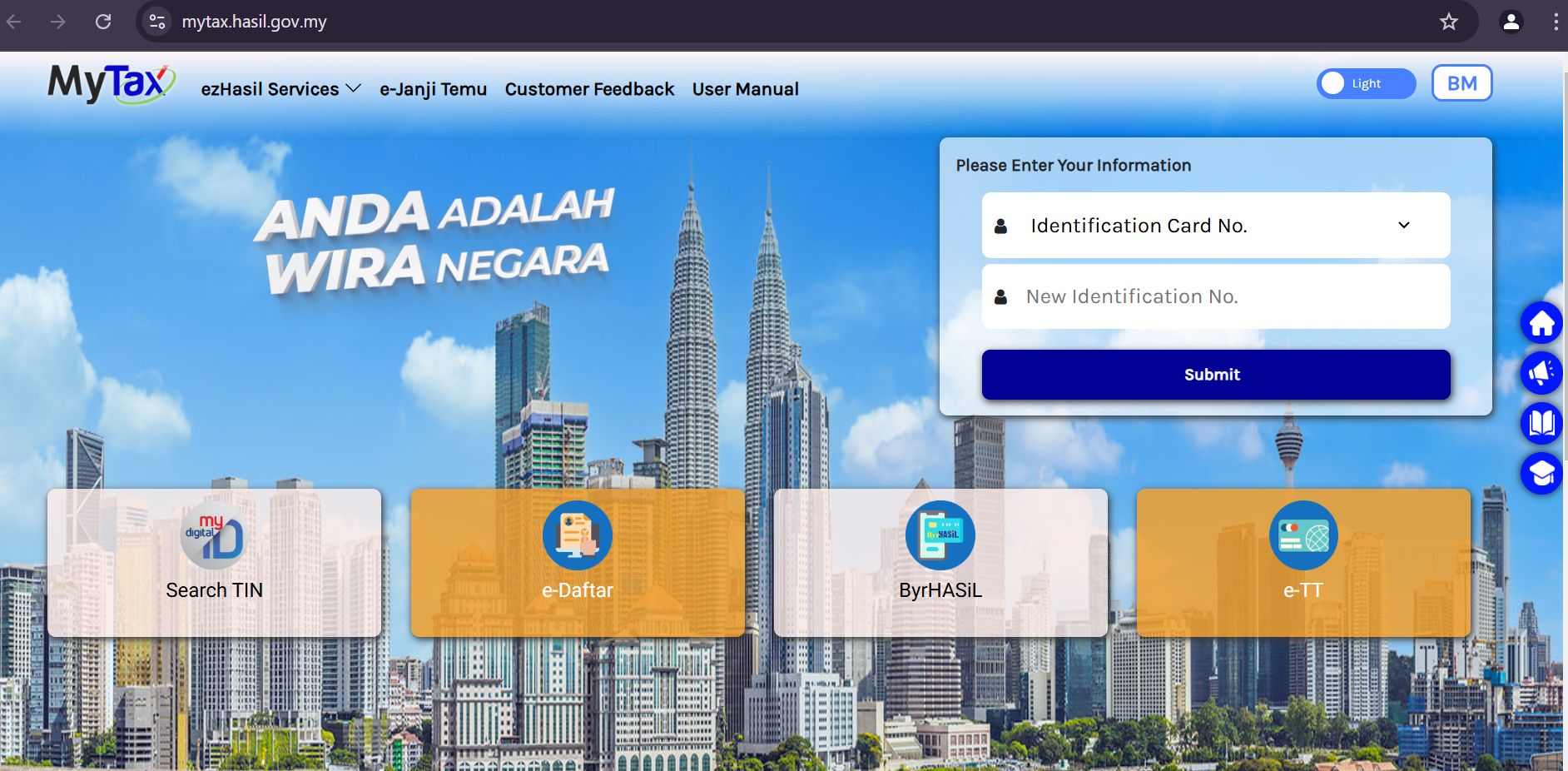

Step 1: Log in to the LHDN MyTax Portal

- Go to MyTax Portal.

-

Click Login via Identification Card No.

-

Enter the company director’s IC number (not the company registration number).

-

Click Submit to log in.

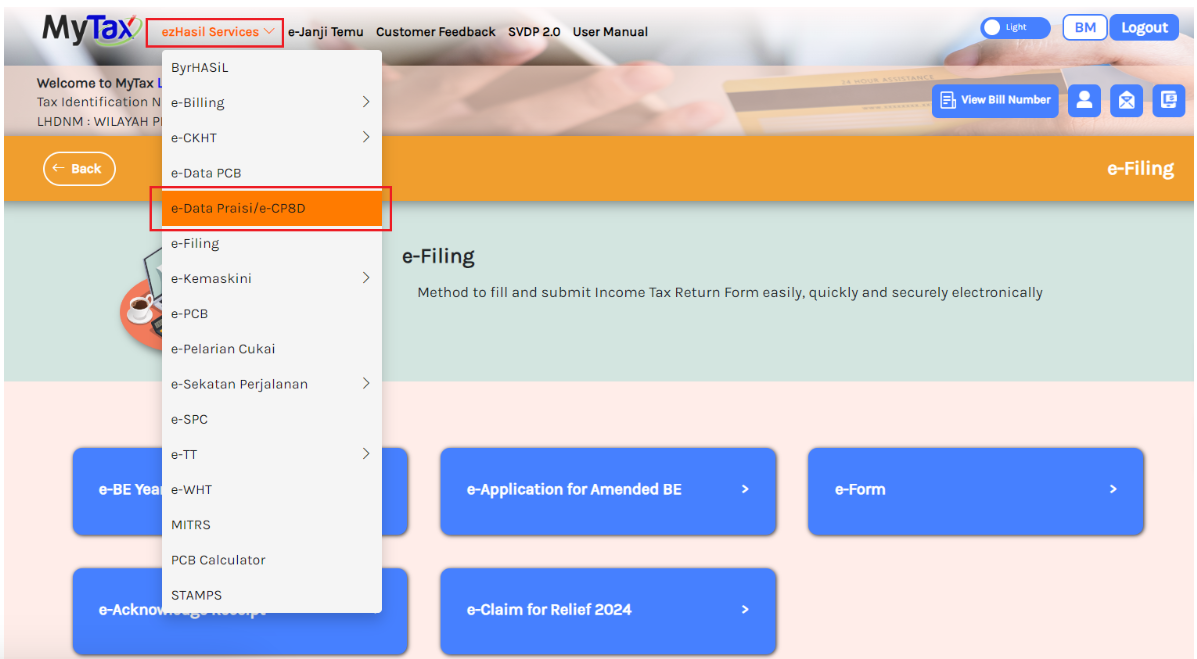

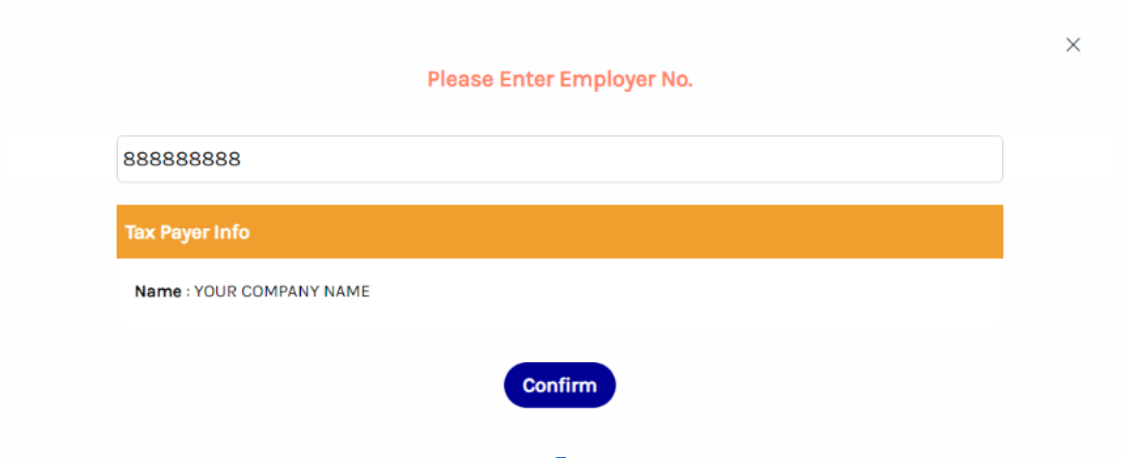

Step 2: Access e-Data Praisi / e-CP8D

- From the homepage, go to ezHasil Services > e-Data Praisi / e-CP8D.

-

Fill in the “Employer Number” and confirm the company details.

-

Click “Confirm” button to proceed.

Step 3: Upload CP8D Data

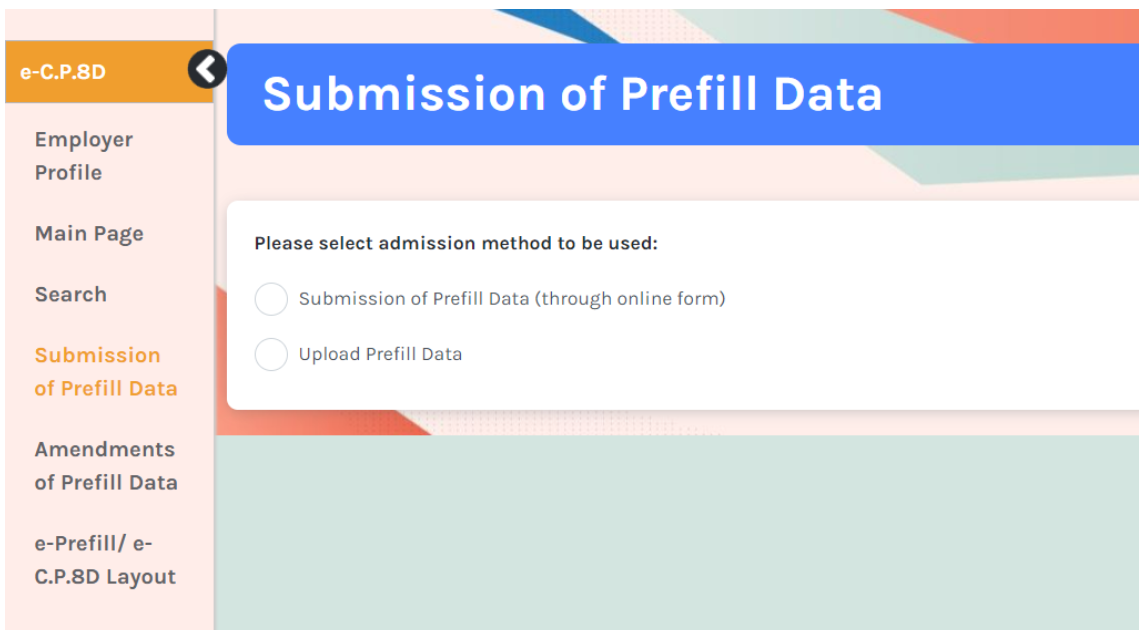

- Go to Submission of Prefill Data.

- Select Upload Prefill Data.

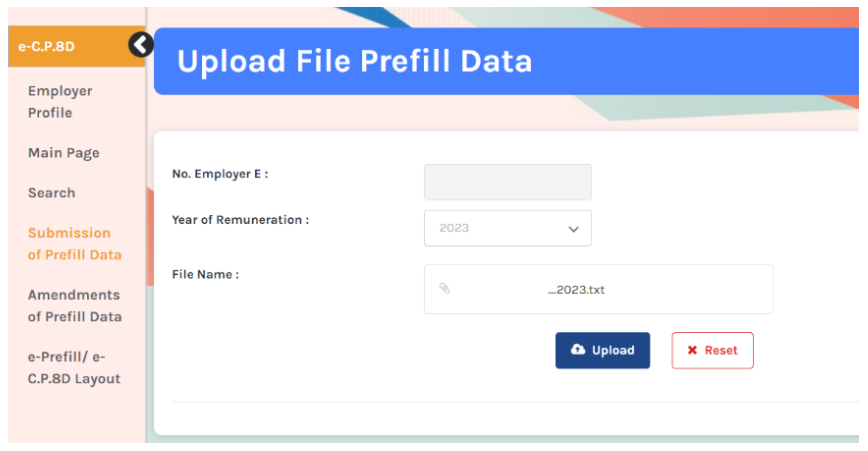

- Select Year of Remuneration.

- Select CP8D text file downloaded from Pandahrms Software.

- Click “Upload” button.

Step 4:

- Scroll down, and double check the data uploaded.

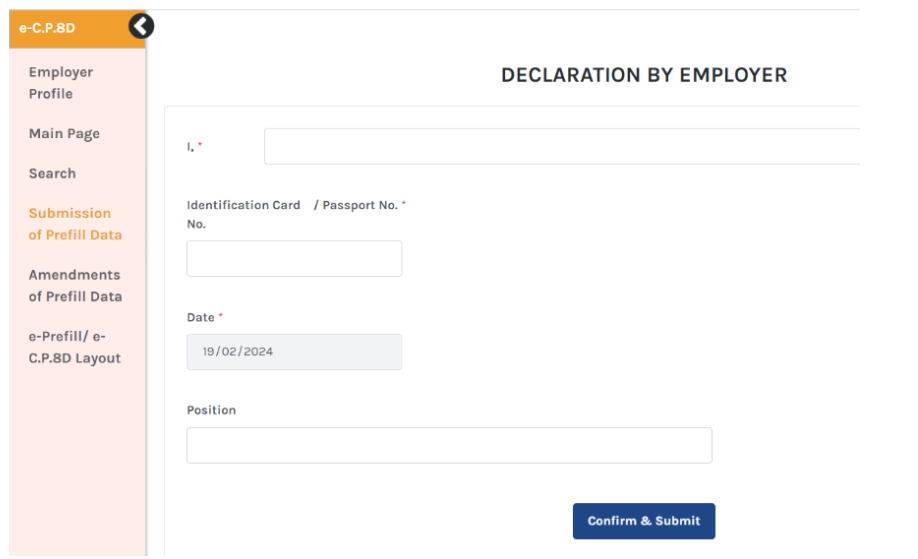

- Fill the Declaration by Employer Form.

- Click “Confirm & Submit”.

- Print “ACCEPTANCE ACKNOWLEDGEMENT OF C.P.8D DATA”.

Step 5:

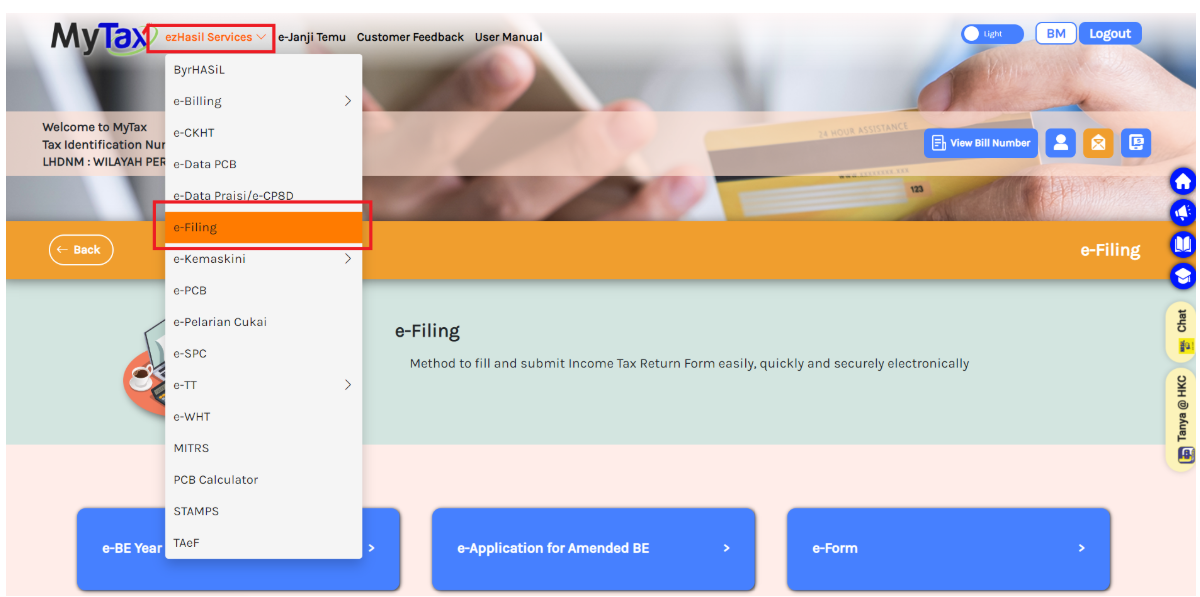

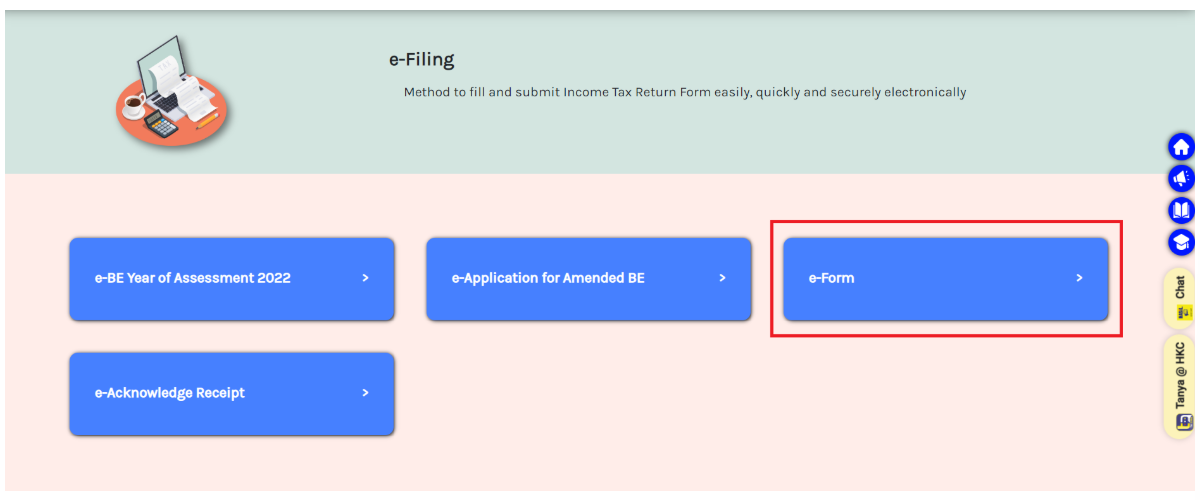

Next, at ezHasil Services > Select e-Filing. Then select e-Form.

Step 6:

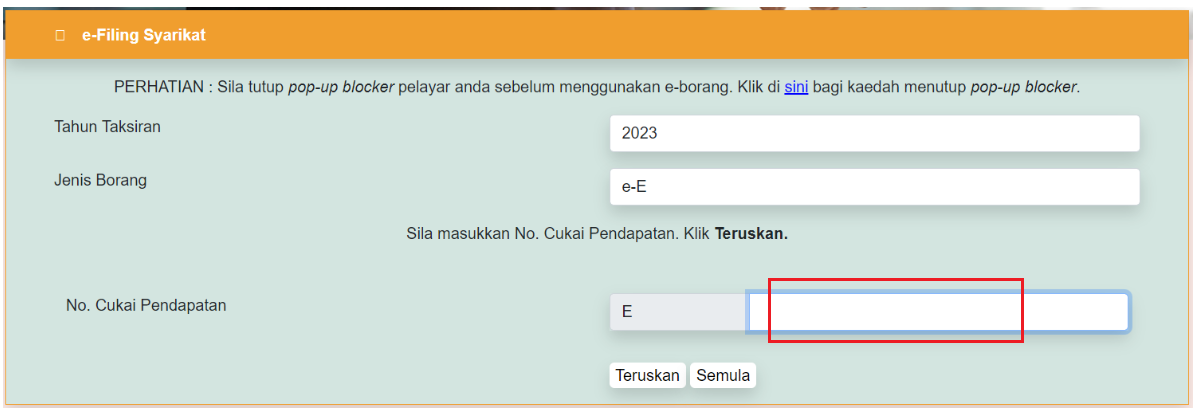

Under e-Form tab, head to Non-Individual > e-E section and select the correct Year of Assessment.

Step 7:

Fill in your Employer’s Tax Number and proceed.

Step 8:

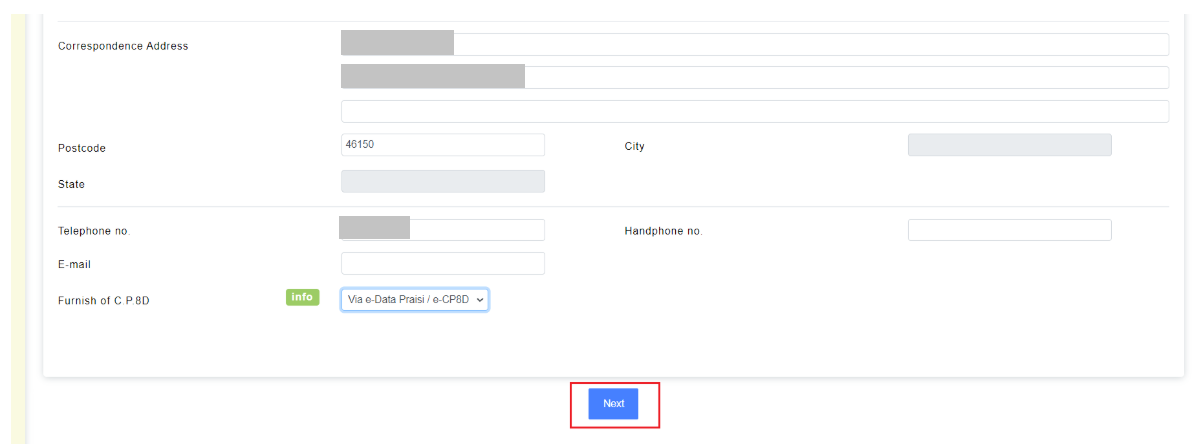

Fill in your company details under the Employer Profile page and click “Next”.

Step 9:

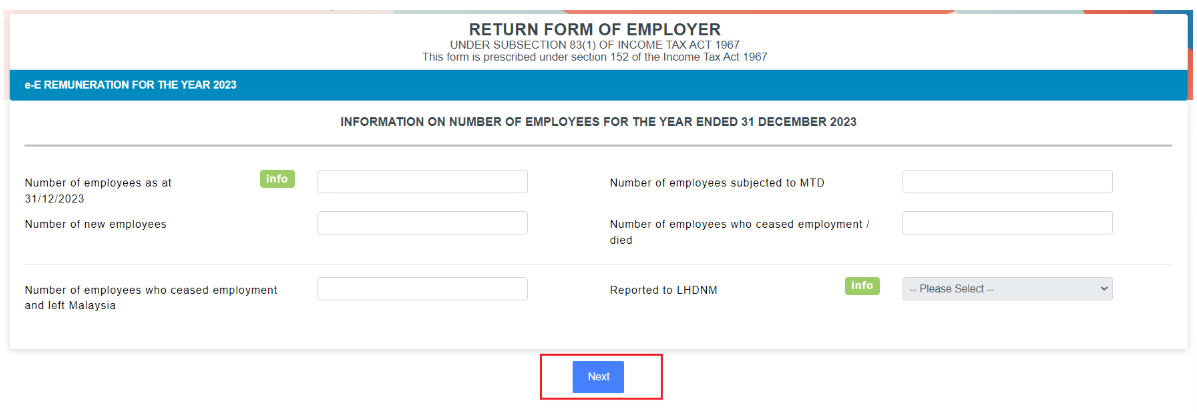

Fill in the total employee details by referring to the information on Form E (PDF format) generated from Pandahrms Software. Then click “Next”.

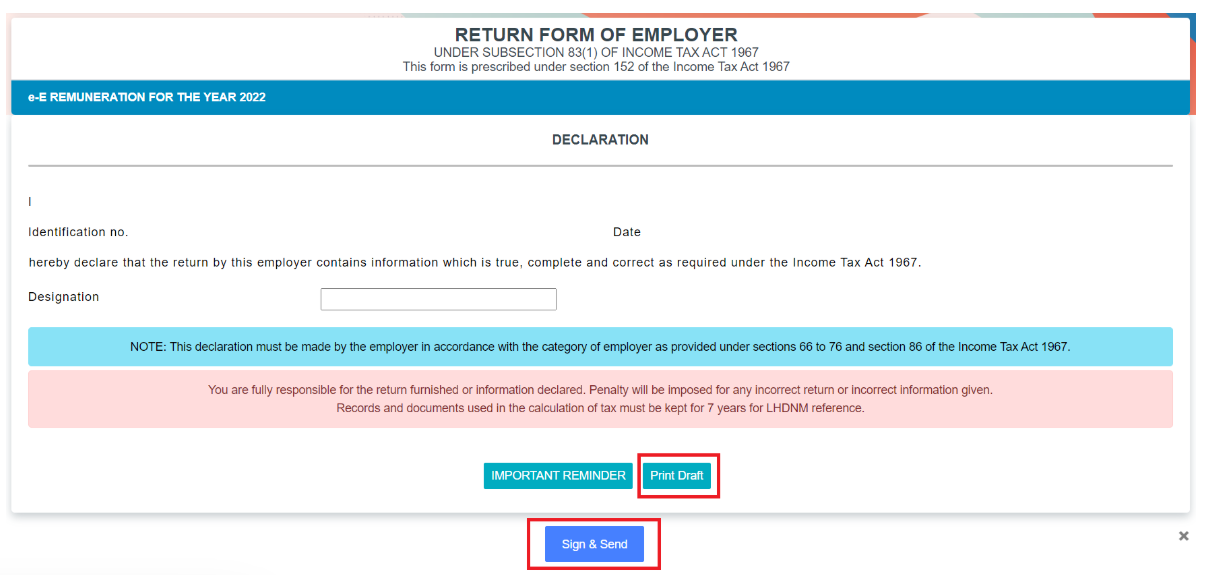

Step 10:

Finally, enter your designation and click on Sign & Send.

You will be required to enter the login IC/passport number and password to sign the form. You will also be able to print the form and submission receipt.