Laid Off in Malaysia? Here’s How to Calculate Your Severance Pay and Final Compensation

If you’ve recently received a layoff notice or a termination letter beginning with the dreaded “We regret to inform you,” it is important to stay calm and informed. Understanding how severance pay works in Malaysia can significantly ease the transition as you search for your next opportunity.

This guide outlines the severance pay entitlements under Malaysian law, how to calculate them, and what other forms of compensation you may be eligible for.

What Is Severance Pay?

Severance pay refers to the compensation provided by an employer to an employee who is terminated due to reasons beyond their control, such as company restructuring, downsizing, or cost-cutting initiatives. It is not related to poor performance or misconduct.

This payout acts as a financial cushion to support employees while they seek new employment opportunities.

Which employees are entitled to termination benefits payment?

According to the Employment (Termination and Lay-Off Benefits) Regulations 1980, an employee is entitled to termination benefits payment when their contract of service is terminated for any reason, except:

- When the employee’s contract is terminated upon reaching age of retirement (if there is a clause within the contract)

- When the employee’s contract is terminated on grounds of misconduct

- When the employee voluntarily terminated their own contract

- If the employee’s contract of service is renewed with equal or improved terms (with renewal taking effect immediately)

How Is Severance Pay Calculated?

The amount of severance pay you are entitled to depends on several factors, primarily:

-

Your total length of service

-

Your monthly salary

-

The method your company uses to calculate working days in a month

Once these variables are determined, you can estimate your severance payout using a simple formula.

Severance Pay According to Years of Service

Under Malaysian labour law (Employment Act 1955), the amount of severance compensation is based on your duration of service:

-

Less than 2 years: 10 days’ wages for each year of service

-

Between 2 to 5 years: 15 days’ wages for each year of service

-

More than 5 years: 20 days’ wages for each year of service

These calculations apply to employees earning below RM4,000/month or those covered under the Act (e.g., manual labourers or domestic workers). However, many companies extend similar severance packages to higher-earning employees as part of their internal policies.

Example Calculation

To illustrate, consider the following scenario:

-

Job role: IT Manager

-

Monthly salary: RM5,000

-

Working days per month: 27

-

Years of service: 6

Since the employee has served more than 5 years, they are entitled to 20 days’ wages per year.

Calculation:

6 years × 20 days = 120 days’ wages

Daily wage = RM5,000 ÷ 27 ≈ RM185.19

Severance pay = 120 × RM185.19 = RM22,222.80

This amount can help cover living expenses during the job-hunting period.

Prefer Not to Calculate Manually?

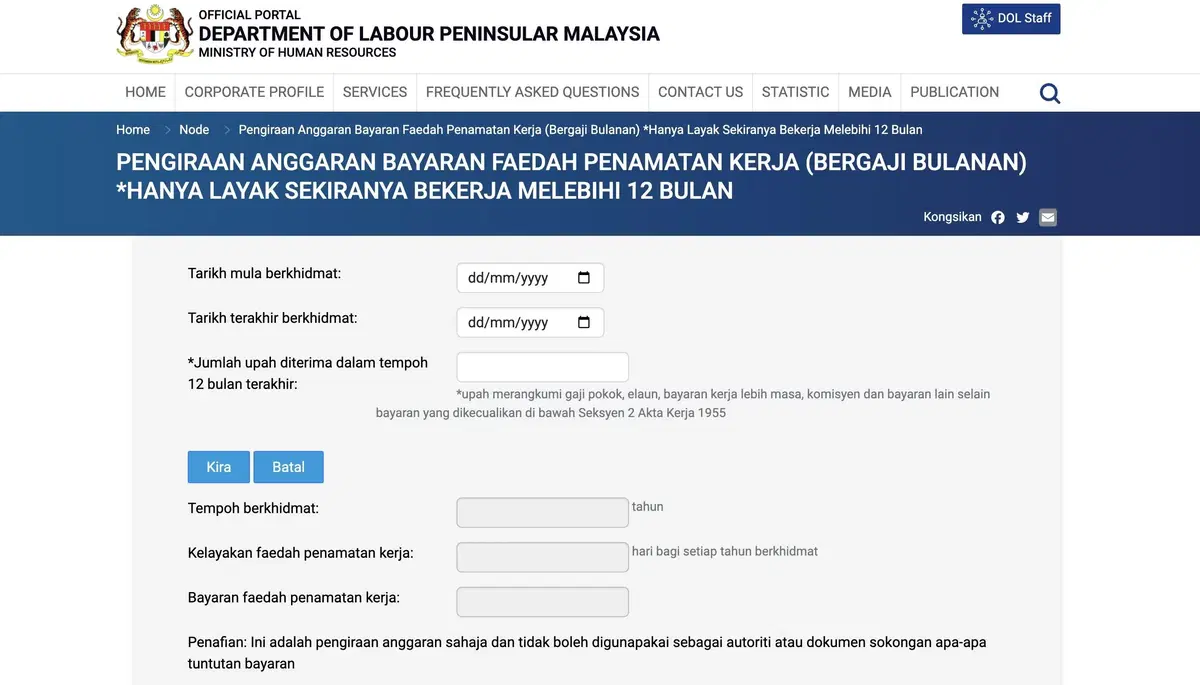

The Ministry of Human Resources (MOHR) provides an online severance pay calculator. You simply need to:

-

Input your start and end dates

-

Enter your total salary over the past 12 months (including commissions, overtime, and allowances)

-

Click “Kira” (Calculate) to view an estimated compensation amount

Please note: This tool provides only an estimate and should not be used as an official calculation for legal disputes. Always confirm your entitlements with HR or seek professional advice.

Other Types of Compensation You May Be Entitled To

Apart from severance pay, the following items may appear in your final payout:

1. Severance Pay

-

Based on your years of service

-

Not subject to EPF, SOCSO, or EIS deductions

2. Gratuity Payment

-

An optional token of appreciation, typically given to long-serving employees

-

Not subject to statutory deductions

3. Payment in Lieu of Notice

-

If your employer terminates your contract without proper notice, you are entitled to payment equivalent to the notice period

-

Also exempt from EPF, SOCSO, and EIS deductions

4. Unused Annual Leave

-

Employers must compensate for any accrued but unused annual leave

-

Subject to statutory deductions such as EPF, SOCSO, and EIS

- Note: Unused sick leave is not payable

What Happens to Medical or Insurance Benefits?

Some employers may choose to extend medical, dental, or insurance coverage for a short duration after termination. However, this is entirely discretionary and not legally required.

It is advisable to clarify your coverage status with the HR department before your final working day.

Final Thoughts: Know Your Rights, Plan Ahead

Losing a job unexpectedly can be distressing. However, understanding your severance entitlements under Malaysian labour law allows you to navigate the situation more confidently.

Whether you’re currently affected or simply preparing for potential uncertainties, being informed helps you safeguard your financial wellbeing and plan your next steps effectively.

Should you receive that unfortunate layoff notice, take a breath—then calculate.