Is Disbursement Taxable in Malaysia? A Guide for HR & Finance Teams

When employees or companies make payments on behalf of someone else—be it clients, government bodies, or vendors—these payments are often recorded as disbursements. But here’s the common HR and finance question: Are disbursements taxable in Malaysia?

This article breaks down what qualifies as a disbursement, its tax treatment, and best practices for HR and payroll compliance.

What Is a Disbursement?

A disbursement is an amount paid by a company or employee on behalf of a third party and later claimed back without any markup. It does not belong to the company but to someone else—usually a client or external party.

Common Examples:

-

Stamp duty or registration fees paid to government agencies for a client

-

Delivery fees paid on behalf of customers

-

Third-party application fees (e.g. visa, license, etc.)

Disbursements are different from reimbursements, which cover expenses incurred for the company (like petrol, meals, or tolls during a work trip).

Tax Treatment: Is Disbursement Subject to Tax?

🔸 Disbursement — Usually NOT Taxable

In Malaysia, disbursements are generally not subject to income tax or SST, provided that:

-

The cost is paid on behalf of a third party

-

There is no profit or markup

-

The expense is clearly itemised

-

The amount is reimbursed exactly (same value)

Why? Because the company is merely acting as an agent and not benefiting from the payment.

💡 LHDN and Royal Malaysian Customs view disbursements as pass-through costs, not business income.

🔸 What Happens If It Doesn’t Meet the Criteria?

If the payment:

-

Is marked up,

-

Is not separately itemised,

-

Is paid for the benefit of the company,

-

Or is bundled with services,

Then it may be reclassified as income or subject to SST (if your company is registered).

Similarly, for employee claims, any misclassified disbursement could be treated as a taxable allowance or benefit-in-kind, which may affect PCB, EPF, and SOCSO calculations.

What Should HR & Payroll Teams Do?

1. Create Clear Claim Categories

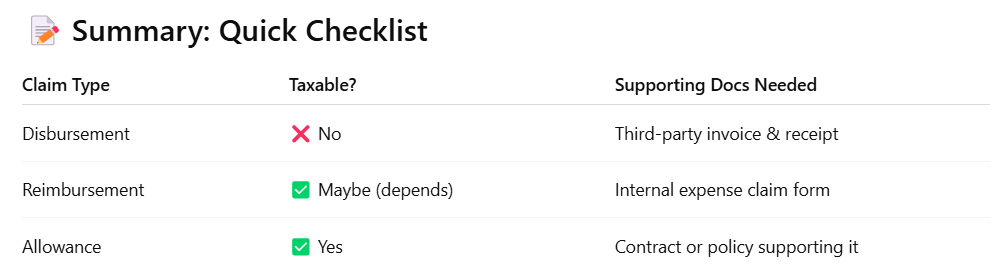

Differentiate between:

-

Disbursements (non-taxable, third-party cost)

-

Reimbursements (may be taxable depending on nature)

Use separate codes or categories in your claim forms or HR system.

2. Ensure Proper Documentation

Always require:

-

Official third-party receipts

-

Proof of payment (e.g. bank transfer, receipt)

-

Description of the third-party beneficiary (e.g. “Client A – SSM fee”)

This helps justify tax treatment and protects the company during audits.

3. Automate with HR Software

Use HR systems like Pandahrms to:

-

Let employees upload claims with categories

-

Track approval flows and payment status

-

Maintain digital records for audits

Having a cloud-based system helps reduce errors and ensures clean reporting of non-taxable disbursements vs taxable reimbursements.

4. Keep Up With LHDN Guidelines

As employment-related tax policies evolve, HR and finance teams should stay updated on:

-

Taxable allowances

-

Benefit-in-kind (BIK) updates

-

Payroll deduction rules (e.g. PCB, EPF, SOCSO, EIS)

Tip: Refer to LHDN’s Public Ruling documents and SST guides from Customs for the latest interpretation of disbursements.

Final Thoughts

Disbursements may seem small, but improper classification can lead to tax penalties and inaccurate payroll reporting. For Malaysian employers, the golden rule is: if it’s not your company’s cost, and there’s no profit, it’s likely non-taxable—but proof is essential.

By using a proper HR system and following clear internal policies, your team can manage employee claims confidently and stay compliant with Malaysia’s tax laws.

✅ Need a system to simplify employee claims and disbursement tracking?

Try Pandahrms – easily manage claims, attach receipts, categorize expenses, and stay compliant. No more Excel headaches or paperwork drama.