In December 2025, many salaried employees in Malaysia were surprised — and even alarmed — to receive a CP500 Instalment Tax Payment Notice, despite earning salary income only. Following this, LHDN issued an official clarification explaining why CP500 notices were sent and what taxpayers should do next.

For employers and HR teams, this situation highlights a common issue: PCB and CP500 are often misunderstood, even though they serve very different purposes in Malaysia’s tax system.

This article breaks down the key differences between PCB and CP500, explains who is responsible, and clarifies what employers need to manage — and what they don’t.

What Is PCB?

PCB (Potongan Cukai Bulanan) is a monthly tax deduction system for employees who earn employment income such as salaries, wages, bonuses, and allowances.

It is part of an employer’s statutory payroll responsibility.

Key Points for PCB

-

Applies to employees / salary earners

-

Calculated and submitted by the employer

-

Deducted directly from monthly salary

-

Based on salary, allowances & PCB tax table

-

Uses employee declarations via Form TP1

In short: PCB is employer-managed and payroll-based.

What Is CP500?

CP500 is an instalment tax payment notice issued by LHDN to individuals who earn non-employment income.

This includes income such as:

-

Self-employment income

-

Rental income

-

Freelance or commission-based income

-

Business income (sole proprietors)

Key Points for CP500

-

Applies to non-salaried income earners

-

Issued by LHDN, not calculated by employers

-

Paid directly by the taxpayer

-

Paid in 6 instalments per year (every two months)

-

Based on previous year’s chargeable income

-

Adjustable via Form CP502

In short: CP500 is taxpayer-managed and not part of payroll.

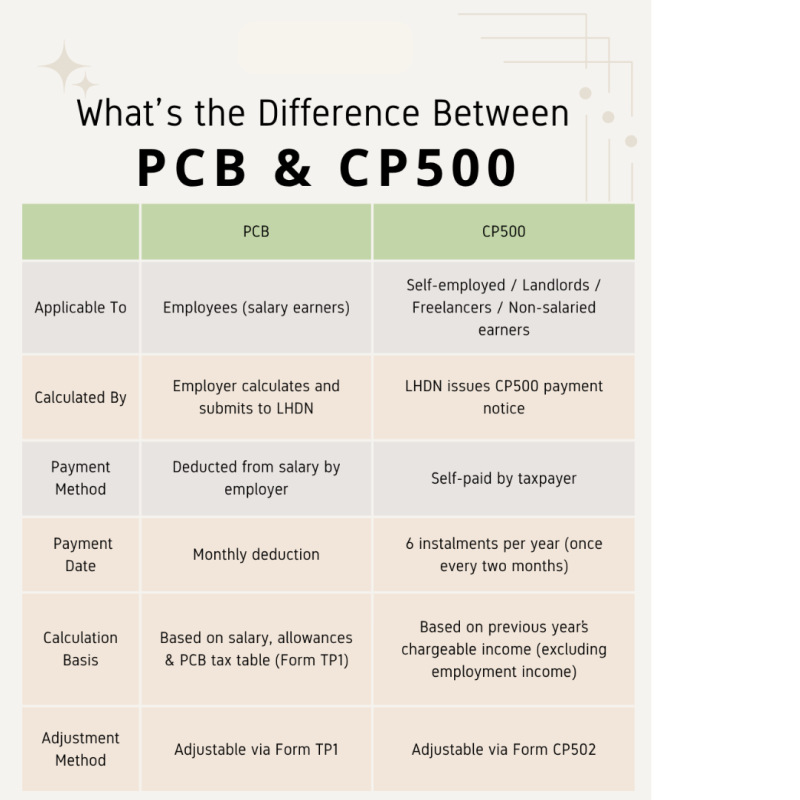

PCB vs CP500 — Key Difference at a Glance

Who Is Responsible?

PCB Responsibility

-

Employer

-

Employer must:

-

Calculate PCB correctly

-

Deduct from salary on time

-

Submit to LHDN monthly

-

Late or incorrect PCB submission may result in penalties borne by the employer.

CP500 Responsibility

-

Taxpayer (individual)

-

Employer is not responsible for:

-

CP500 calculations

-

CP500 payments

-

CP500 penalties

-

Penalties: What Employers Should Know

PCB (Employer Liability)

-

Fine: RM200 – RM20,000, or

-

Imprisonment up to 6 months, and

-

10% penalty on unpaid tax amount

CP500 (Taxpayer Liability)

-

10% penalty on unpaid instalment amount

-

Penalty is borne by the taxpayer, not the employer

Why Did Salary-Only Employees Receive CP500?

According to LHDN’s clarification, CP500 may be issued if:

-

There is past non-employment income

-

There are data mismatches from previous tax filings

-

The system flags historical chargeable income

Receiving CP500 does not automatically mean tax is payable.

Affected individuals should review and, if needed, submit Form CP502 to revise the instalment amount.

What Employers & HR Teams Should Do

✔ Ensure PCB calculations are accurate and compliant

✔ Educate employees that PCB ≠ CP500

✔ Clarify that CP500 is not payroll-related

✔ Encourage affected employees to check with LHDN or submit CP502

How Pandahrms Helps Employers Stay Compliant

With Pandahrms Payroll, employers can:

-

Automate accurate PCB calculations

-

Apply correct tax tables and allowances

-

Reduce human error in monthly payroll

-

Stay compliant with LHDN requirements

This allows HR teams to focus on what matters — while avoiding costly compliance mistakes.

Final Takeaway

PCB and CP500 serve different tax purposes.

Understanding the difference helps employers:

-

Avoid unnecessary panic

-

Communicate clearly with employees

-

Stay compliant with Malaysian payroll regulations

For employers, the rule is simple:

👉 Manage PCB properly — CP500 is not your payroll responsibility.