Dear Pandahrms Users,

The previous system for submitting Monthly Tax Deductions (PCB) has been deactivated, and LHDN has introduced the new and improved e-PCB Plus system, which is now officially live. This system will replace the existing e-CP39, e-PCB, and e-Data PCB systems for the submission of PCB (Potongan Cukai Bulanan) statements and payments, including CP38 deductions. We are pleased to inform you that Pandahrms is fully updated and compatible with this new system.

This guide walks you through the step-by-step process of generating and submitting your e-PCB Plus file using Pandahrms.

How to Submit e-PCB Plus

1) Generate Tax File

Prerequisite:

● Ensure that your monthly payroll has been processed before proceeding with the Auto Pay Generator.

Step 1: Navigate to Auto Pay Generator

● Go to “Payroll” -> “Payment Processing” -> “Autopay Generator”.

Step 2: Generate EA

● Fill up the “Autopay Generator” form.

● Go to “Tax”.

● Click the “Download” button.

Note A: File Downloaded

🔹The file will be automatically downloaded to your browser’s default download folder.

2) Upload to LHDN Portal:

Prerequisite:

You must be an ‘Employer’ or an ‘Employer Representative’ to perform this action.

Step 1: Visit e-PCB Data Official Portal

● Navigate to https://mytax.hasil.gov.my/

● Login with your credentials.

Step 2: Navigate to e-PCB Plus

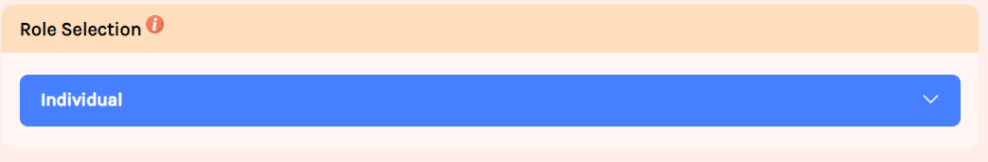

● Role Selection -> Click “Individual” -> Select “Employer” / “Employer Representatives” -> Select Company Name.

● Go to ezHasil Services -> e-PCB Plus -> e-PCB Plus.

Step 3: Navigate to Upload Data, Check and Pay

● Go to “Services” -> Click “e-Data PCB” -> Click “Upload Data, Check and Pay”.

Step 4: Upload text file.

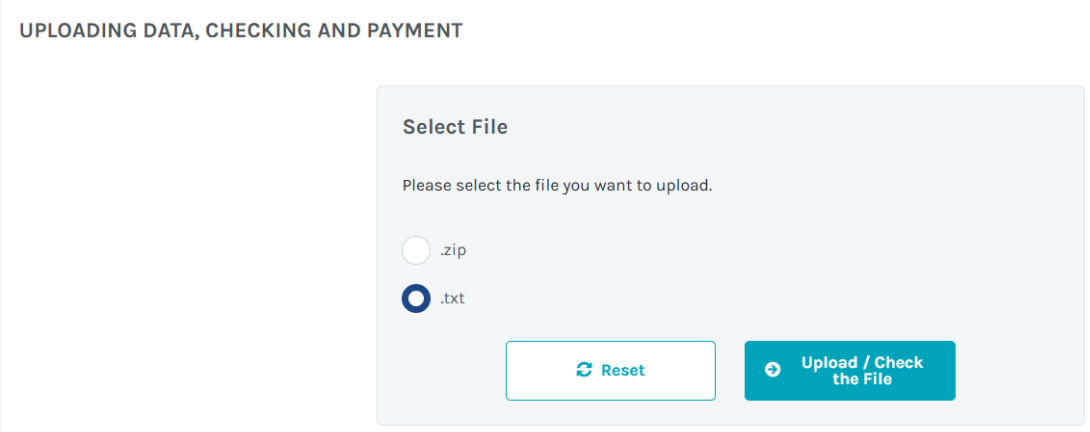

● Click “.txt” -> Click “Upload / Check the File” Button.

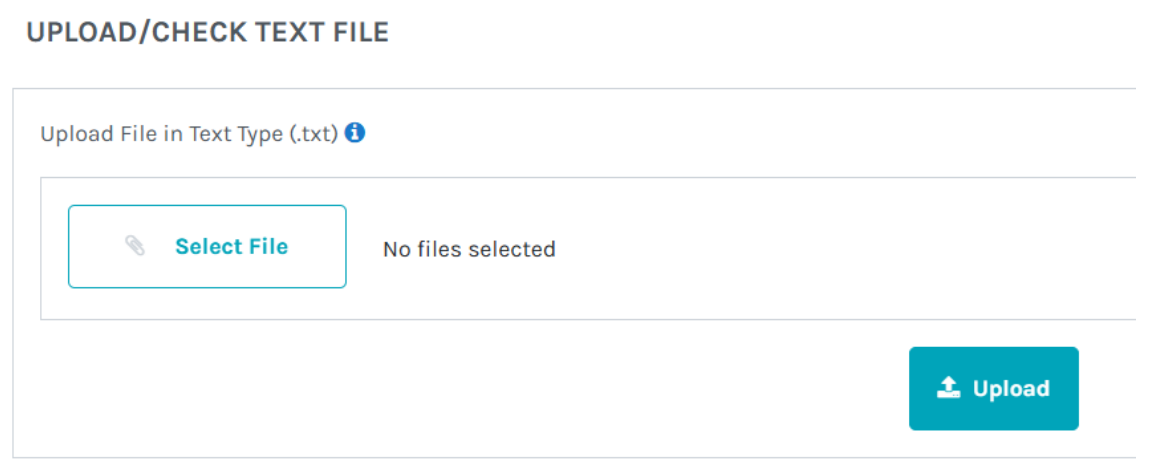

● Click “Select File” -> Select the Auto Pay File Generated by Pandahrms -> Click “Upload”.

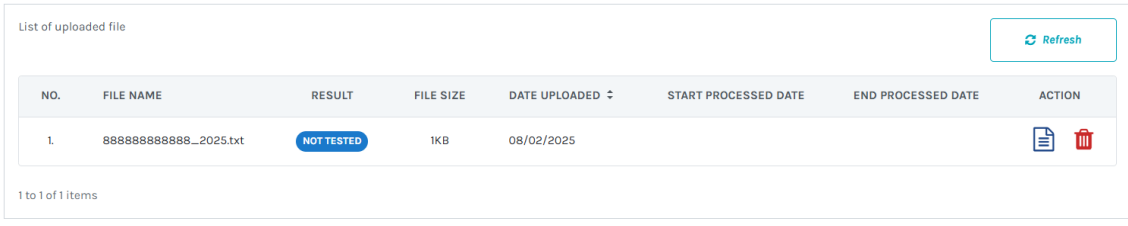

● Once the file has been uploaded successfully, the file name will appear at the bottom of the website.

● Go To “Action” -> Click “Check Data” ![]() button.

button.

Note 1: File Being Processed by e-Data PCB

• This process may take some time. Please click the “Refresh” button every few minutes.

• The result will change from “BEING PROCESSED” to either “PASS” or “FAIL”.

Note 2: File Processing FAIL

• Go To “Action” -> Click “View Data” ![]() button.

button.

• Go To “Result” -> Click “FAIL”

• Data Error will be displayed in this page. Please follow the instructions to update the employee data in Pandahrms System, redownload the Auto Pay Tax File and reupload.

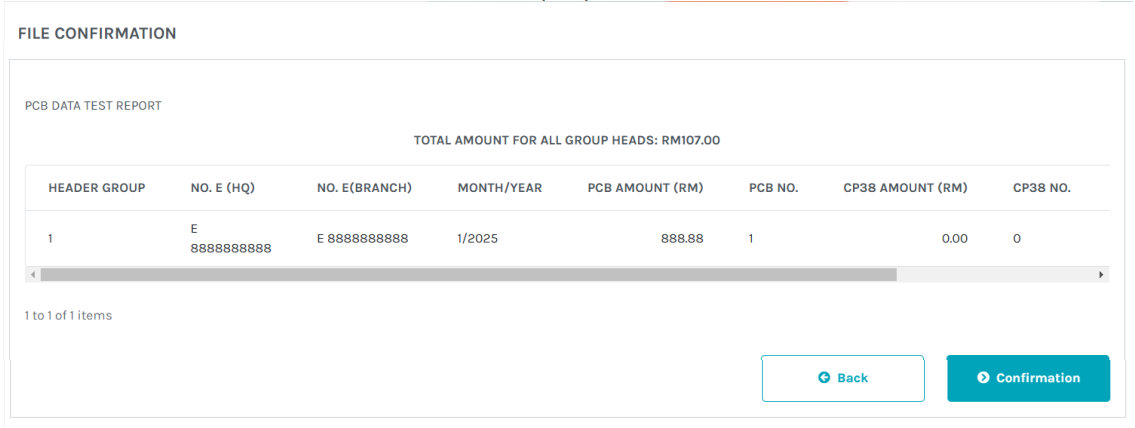

Note 3: File Processing PASS

• Go To “Action” -> Click “View Data” ![]() button.

button.

• Click “Confirmation” Button to make payment.