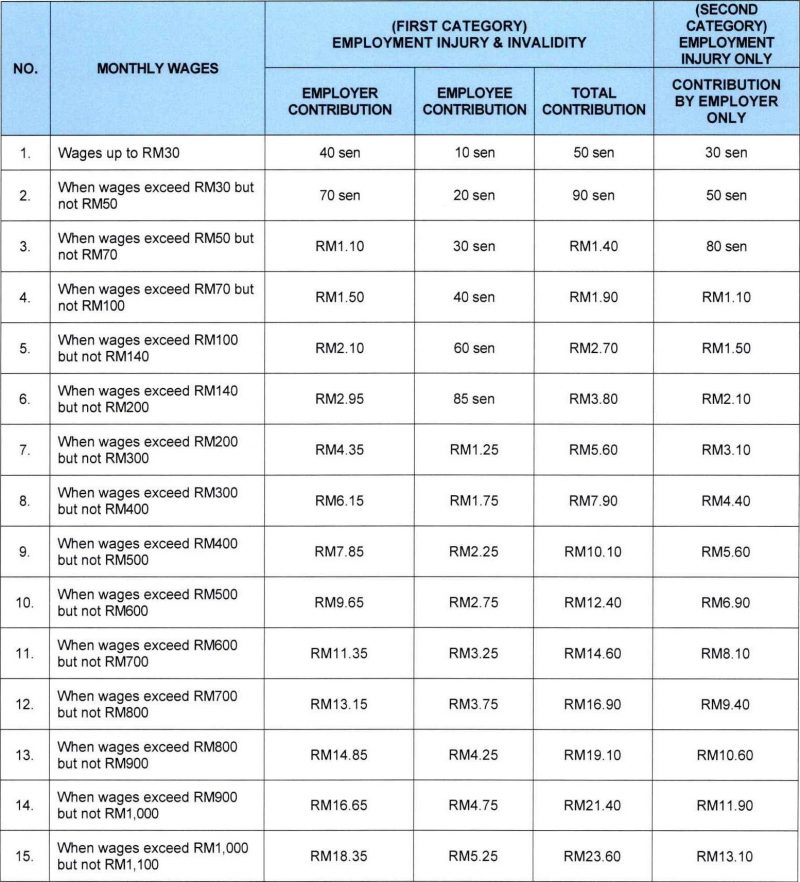

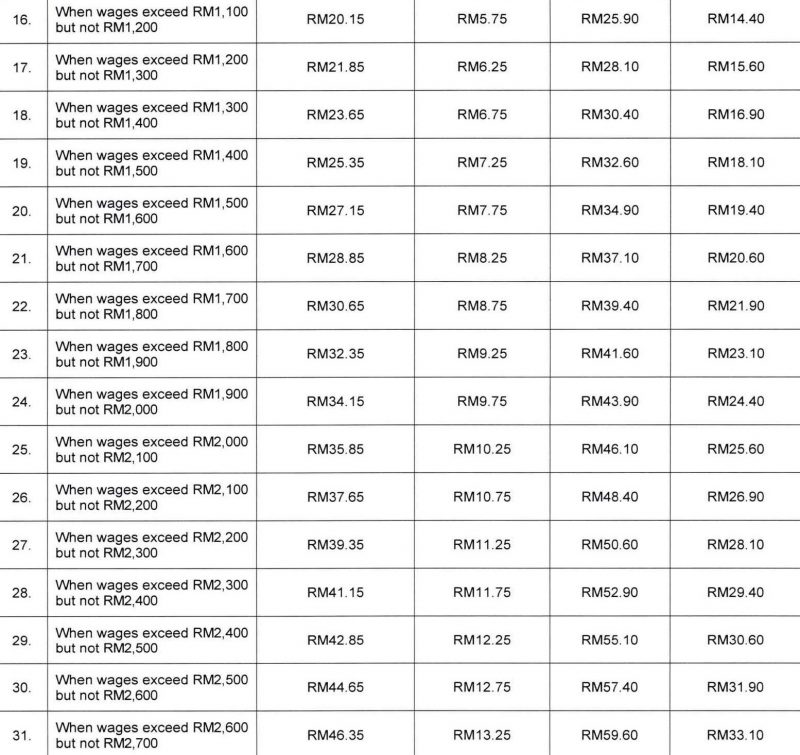

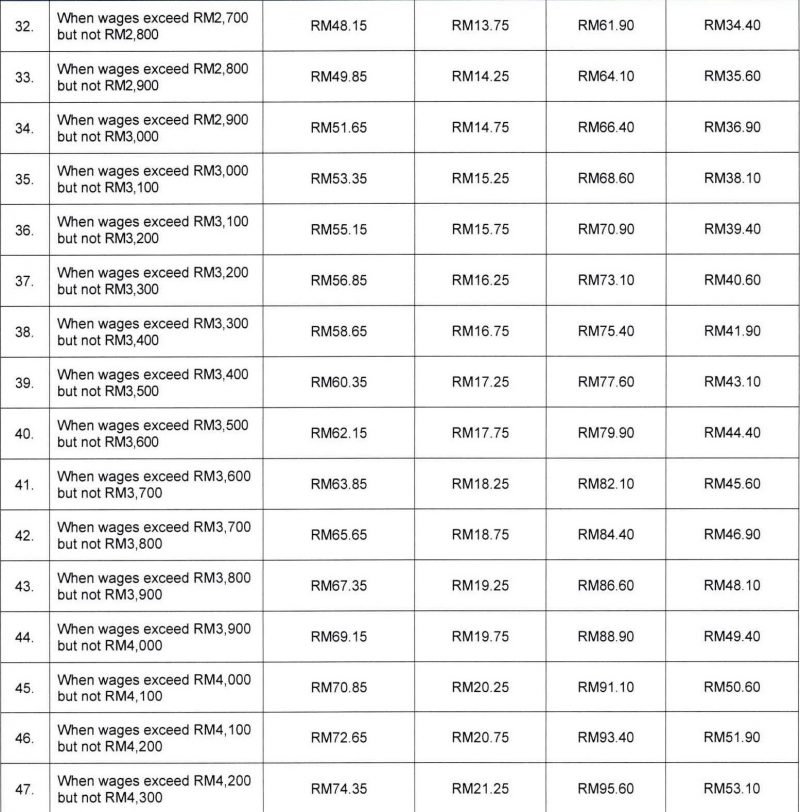

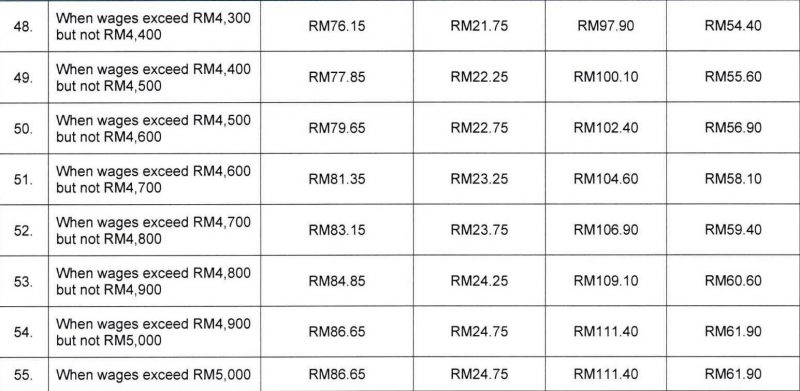

THIRD SCHEDULE: EMPLOYEES’ SOCIAL SECURITY ACT 1969 (ACT 4)

1. PURPOSE

The purpose of this circular is to inform the obligation of employers who are employing foreign workers, including expatriates and foreign domestic workers, to ensure their foreign workers are covered under the Invalidity Scheme through the provision under the Employees’ Social Security Act 1969 (Act 4) effective 1 July 2024.

2. BACKGROUND

2.1 The extension of the Invalidity Scheme coverage to foreign workers under Act 4 is effective from 1 July 2024 through the following Government Gazette:

i. Employees’ Social Security (Amendment of First Schedule) Order 2024 – [P.U.(A) 180/2024];

11. Employees’ Social Security (Exemption of Benefit For Foreign Worker) Notification 2024 – [P.U.(B) 240/2024]; and

iii. Employees’ Social Security (Amount of Funeral Benefit) (Amendment) (No.2) Regulations 2024- [P.U.(A) 181/2024].

2.2 “Foreign worker” covered under Act 4 is a foreign worker who possess a valid pass or permit issued by the Director General of Immigration for the purpose of working in Malaysia.

3. EFFECTIVE DATE OF IMPLEMENTATION

3.1 All foreign workers who are employed by employers SHALL contribute to PERKESO under the Invalidity Scheme effective 1 July 2024.

4. APPLICABILITY

4.1 All employers employing foreign workers who possess a valid pass or permit issued by the Director General of Immigration for the purpose of working in Malaysia.

5. PAYMENT OF INVALIDITY SCHEME CONTRIBUTION

5.1 With the implementation of the Invalidity Scheme for foreign workers, employers must contribute according to the Contribution Rate (Appendix 1 – Third Schedule) for both the employer’s and the foreign worker’s shares:

– First Category Contribution (Employment Injury Scheme and Invalidity Scheme):

For foreign workers under 55 years old entering the PERKESO scheme for the first time.

– Second Category Contribution (Employment Injury Scheme):

For foreign workers who are 55 years old or older when they first enter the PERKESO scheme or are 60 years old and still working.

5.2 The contribution payment can made by employers online either through the ASSIST Portal or Internet Banking starting the contribution month of July 2024.

5.3 Contributions payable for any month shall be paid no later than the 15th day of each succeeding month.

5.4 The employer shall ensure that the deduction for the employer’s share and foreign worker’s share of contribution are stated in the payslip and must be given to the foreign worker.

6. SUBMISSION OF RECORDS FOR THE PURPOSE OF CONTRIBUTION PAYMENT

6.1 Submission of the foreign worker’s records for contribution payment purpose shall be done online through ASSIST PORTAL OR INTERNET BANKING by using the Foreign Worker Social Security Number (SSFW No. – 12 digits) for foreign workers and expatriates or Foreign Domestic Worker Social Security Number (SSFDW No. – 12 digits) for foreign domestic workers.

7. ENQUIRY

For any enquiries, please contact PERKESO Customer Service at 1-300-22-8000 or visit PERKESO’s official website at www.perkeso.gov.my or email to perkeso@perkeso.gov.my.