As an employer in Malaysia, it’s essential to understand your responsibilities when it comes to your employees’ income tax filing. One of those responsibilities involves the TP1, TP2, and TP3 forms — key documents used for capturing individual employee tax reliefs and income records. This guide breaks down what each TP form is for, when to use it, and how to handle them efficiently.

What is Form TP1?

Form TP1 allows employees to declare their eligible tax reliefs, deductions, and rebates in advance so that their Monthly Tax Deduction (MTD/PCB) is adjusted accordingly. By submitting this form to their employer, employees can ensure that their monthly salary is taxed more accurately and fairly based on their actual entitlements.

Who Should Submit TP1?

Employees who wish to reduce their Monthly Tax Deduction (MTD/PCB) by declaring additional tax reliefs or rebates should submit Form TP1 to their employer.

New hires or employees changing jobs are not required to submit Form TP1 immediately—unless they want their PCB to reflect eligible reliefs or rebates right from the start.

When Should Employers Process Form TP1?

Employers are responsible for processing Form TP1 promptly upon receipt from the employee.

As the information provided in Form TP1 directly impacts the employee’s Monthly Tax Deduction (MTD/PCB), it is advisable that the form be submitted before the payroll cut-off date for the respective month to ensure timely adjustments within the same salary cycle.

Where Should Employers Keep Form TP1?

Employers do not need to submit the TP1 Form to LHDN. However, they must keep a copy for at least seven years for record-keeping and audit purposes.

The HR or payroll department should have a structured filing system to store these forms securely.

Common Tax Reliefs Claimable Under TP1

Employees can claim tax reliefs such as:

-

EPF and Life Insurance: Contributions to retirement savings and insurance.

-

Medical and Education Expenses: Personal and family medical treatments, and tuition fees.

-

Childcare Fees and Parental Care: Expenses for children and dependent parents.

-

Books, Internet, and PRS Contributions: Purchase of educational materials and private retirement savings.

Download Form TP1 PDF

Download the TP1 Form HERE

What is Form TP2?

Form TP2 enables employees to declare additional tax deductions specifically related to one-off payments such as bonuses, commissions, or lump-sum incentives.

By submitting this form, employees can help prevent excessive Monthly Tax Deduction (MTD/PCB) from being applied to these irregular payments.

Who Needs to Submit TP2 Form?

Existing employees who want to update their tax reliefs, deductions, or rebates should submit the TP2 Form.

This form is not required for new hires or employees changing jobs, as they should submit a TP3 Form instead.

When to Submit TP2 Form?

Employers should process the TP2 Form as soon as an employee submits it, preferably before payroll processing.

This ensures that any changes in tax reliefs, deductions, or rebates are reflected in the next salary cycle.

Delays in processing may result in incorrect PCB deductions, leading to tax adjustments later.

Where Should Employers Keep TP2 Form?

Employers are not obligated to submit the TP2 Form to LHDN; however, they must retain it in their internal records for a minimum of seven years.

Download TP2 Form PDF

Download the TP2 form HERE

What is Form TP3?

When starting a new job, many employees may overlook a critical tax obligation—submitting Form TP3 to their new employer. This form plays an essential role in ensuring that income, deductions, and benefits from a previous job are accurately reflected in current payroll records, thereby preventing errors in Monthly Tax Deduction (MTD/PCB) calculations.

Form TP3 is a tax declaration document that employees are required to submit to their new employer when they change jobs within the same assessment year.

It contains important information such as the employee’s prior income, tax deductions, statutory contributions, and benefits received from the former employer. This ensures continuity and accuracy in tax calculations under Malaysian tax regulations.

When Should TP3 Be Submitted?

Employees are advised to submit Form TP3 as soon as they commence employment with a new company.

Early submission allows the HR or payroll department to calculate the employee’s MTD (Monthly Tax Deduction) or PCB (Potongan Cukai Bulanan) accurately from the outset, helping to avoid over- or under-deductions.

Who Needs to Submit Form TP3?

Any employee who switches employers within the same tax year is required to complete and submit Form TP3.

Failure to do so may result in the new employer being unaware of the employee’s previous income and tax deductions, potentially leading to inaccurate MTD deductions.

Where to Submit Form TP3?

Employees should submit the completed TP3 Form to the HR or payroll department of their new employer.

The employer will then use the provided information to adjust the MTD calculations accordingly and report it to LHDN (Lembaga Hasil Dalam Negeri Malaysia).

Information Required in Form TP3

Form TP3 includes key details necessary for accurate tax computation:

-

Previous employer’s details: Company name and tax reference number

-

Employee’s personal details: Full name, IC number, and tax file number

-

Prior income: Basic salary, allowances, and any benefits-in-kind

-

Contributions and deductions: EPF, SOCSO, EIS, and tax reliefs or rebates claimed

-

Taxes already paid: Total PCB deductions and Zakat contributions

Download TP3 Form (PDF)

Download the TP3 form HERE

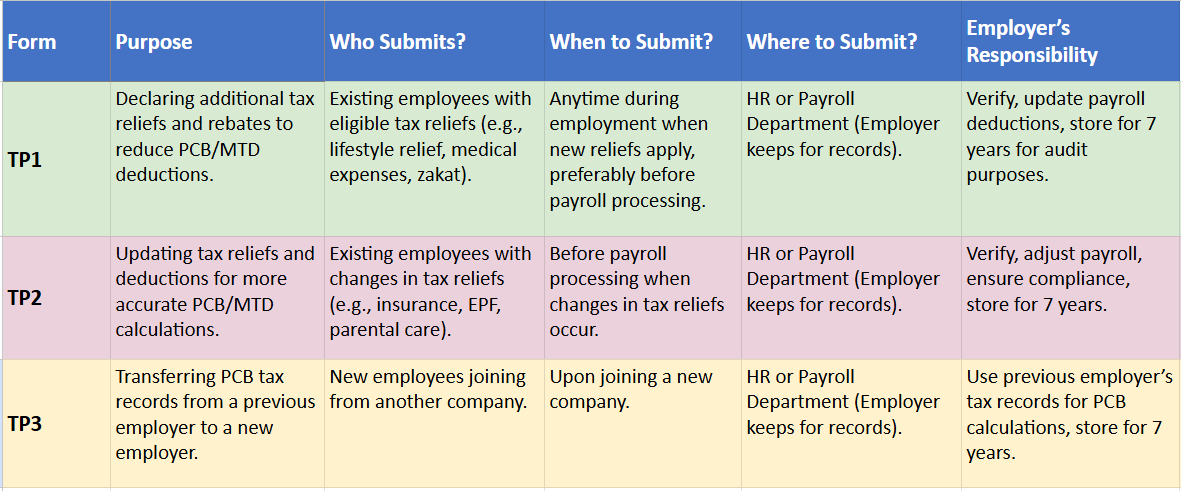

TP1 vs TP2 vs TP3 Form – At a Glance

How to Submit TP1, TP2, and TP3 Form

When a new employee submits these forms, employers must follow a structured process to ensure accurate tax deductions.

Below is a step-by-step guide on how to handle the TP1, TP2, & TP3 Form submission:

1. Receive and Verify These Forms

Once an employee submits the Forms, check if all required fields are filled correctly.

Ensure the employee has provided details of their previous employment, including income, tax deductions, and reliefs.

If there are missing details, ask the employee to complete the form before proceeding.

2. Keep a Copy for Records

Employers do not need to submit the TP3 Form to LHDN.

However, it is essential to keep a copy of the form for at least seven (7) years in case of an audit or request from LHDN.

Store it securely in the employee’s payroll file or HR system.

3. Adjust the Employee’s Monthly Tax Deduction (PCB/MTD)

Using the details from the TP3 Form, update the payroll system to ensure the correct amount of PCB (Potongan Cukai Bulanan) is deducted.

Include previous income, reliefs, and deductions so the employee is not over-taxed.

4. Run Payroll with Updated Tax Calculations

Before processing the next payroll, double-check that the employee’s updated tax calculation is reflected in the system.

This ensures the correct tax amount is deducted and avoids any discrepancies in LHDN reporting.

5. Monitor for Any Future Adjustments

If the employee submits additional updates on their tax reliefs or deductions later in the year, adjust the payroll system accordingly.

Keeping track of tax changes will help avoid over-deductions and ensure compliance with LHDN regulations.

Conclusion

Understanding and correctly processing TP1, TP2, and TP3 forms is vital for both employers and employees to ensure proper tax deductions and compliance with LHDN requirements. By handling these forms efficiently, companies can avoid payroll issues while helping employees optimize their tax obligations.