EPF contribution is one of the most fundamental payroll and statutory obligations for employers in Malaysia. It refers to the mandatory monthly savings scheme where both employees and employers contribute a portion of wages into the Employees Provident Fund (EPF), with the objective of helping employees build long-term retirement savings.

For employers, EPF is more than a deduction exercise. It directly affects employee take-home pay, total payroll cost, and ongoing compliance with EPF regulations. Errors in calculation, classification, or submission—especially when repeated monthly—can lead to penalties, audits, and employee dissatisfaction.

This guide explains how EPF contributions work in Malaysia, using practical scenarios and employer-focused examples to help HR teams manage payroll accurately and consistently.

Who Needs to Contribute to EPF in Malaysia?

EPF contribution requirements depend on the employment relationship and the employee’s nationality.

Are EPF Contributions Mandatory for Malaysian Employees?

Yes. Malaysian employees working under a contract of service or apprenticeship are required to contribute to EPF, and their employers must also contribute every month. Contributions are calculated based on the employee’s wages for that month and the applicable EPF rates.

This requirement applies regardless of whether wages are paid monthly, weekly, or daily.

Do Non-Malaysians Need to Contribute to EPF?

From wages for October 2025 onward, EPF has implemented mandatory contributions for non-Malaysian employees who meet specific criteria, such as holding a valid work pass and receiving wages in Malaysia. In these cases, both employer and employee contributions apply according to the prescribed schedule.

Employers should closely monitor regulatory updates to ensure correct treatment of foreign employees.

What Are the EPF Contribution Rates?

EPF contribution rates are expressed as a percentage of an employee’s monthly salary and are determined by the authorities. These rates may change due to policy updates.

Even a small rate error—if repeated monthly—can result in significant under-contribution or over-contribution over time. This is one of the most common EPF compliance issues faced by employers in Malaysia.

How Do Employers Calculate EPF Contributions?

EPF contributions consist of two components:

-

Employee contribution

-

Employer contribution

Both are calculated using the employee’s monthly salary.

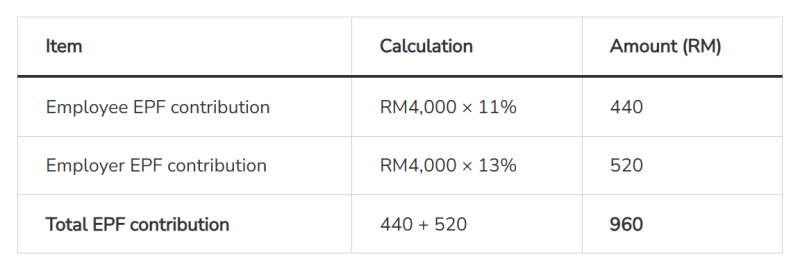

Scenario 1: Basic EPF Contribution Calculation

Scenario

-

Employee type: Malaysian

-

Monthly salary: RM4,000

-

Employee contribution rate: 11%

-

Employer contribution rate: 13%

The employer submits the total EPF contribution of RM960 to EPF every month on behalf of the employee.

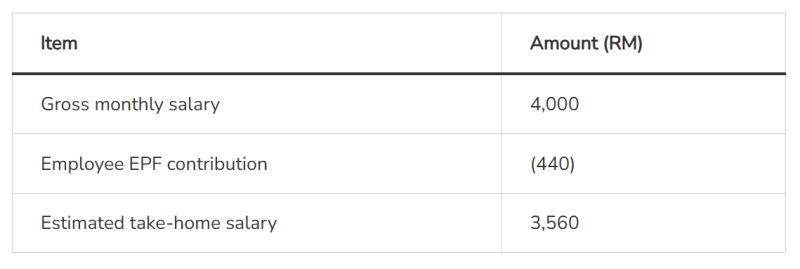

How Does EPF Affect Take-Home Salary?

The employee portion of EPF is deducted before salary is paid, reducing the employee’s net (take-home) pay.

Scenario 2: Take-Home Salary Illustration

While EPF reduces immediate cash in hand, it plays a critical role in building retirement savings over time.

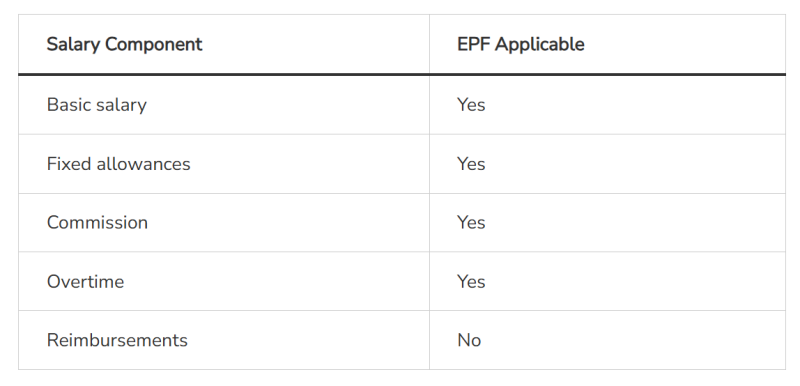

What Salary Components Are Used for EPF Calculation?

Not all salary components are treated the same under EPF rules. Employers must correctly identify which components are EPF-applicable to avoid compliance errors.

Common Salary Components and EPF Applicability

Misclassification of salary components is one of the most frequent reasons EPF contributions do not match expectations.

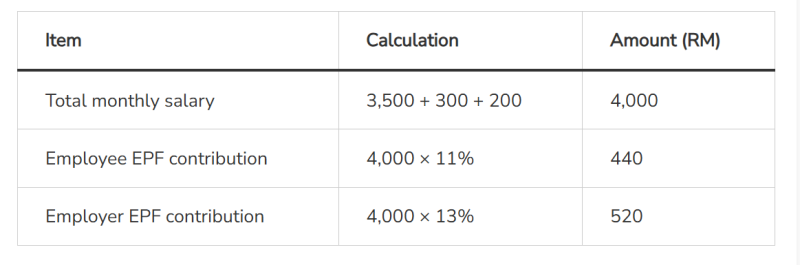

How Do EPF Contributions Work With Allowances or Overtime?

When allowances or overtime are paid, the EPF-applicable salary may vary from month to month.

Scenario 3: EPF Contribution With Allowances

Scenario

-

Basic salary: RM3,500

-

Fixed allowance: RM300

-

Overtime: RM200

This highlights why payroll records must clearly show how each month’s salary is structured.

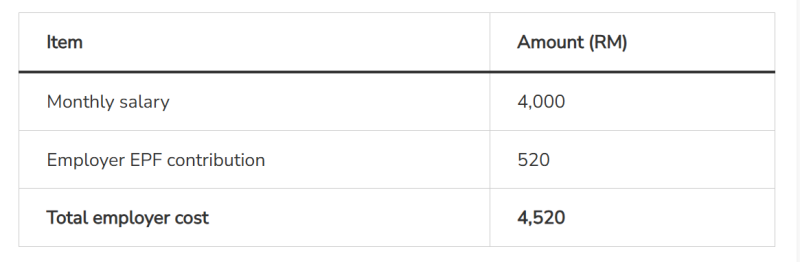

How Should Employers Budget EPF as a Payroll Cost?

EPF should be viewed as part of the total cost of employment, not merely an employee deduction.

Scenario 4: Employer Cost Illustration

This approach helps employers forecast staffing costs more accurately and avoid budget surprises.

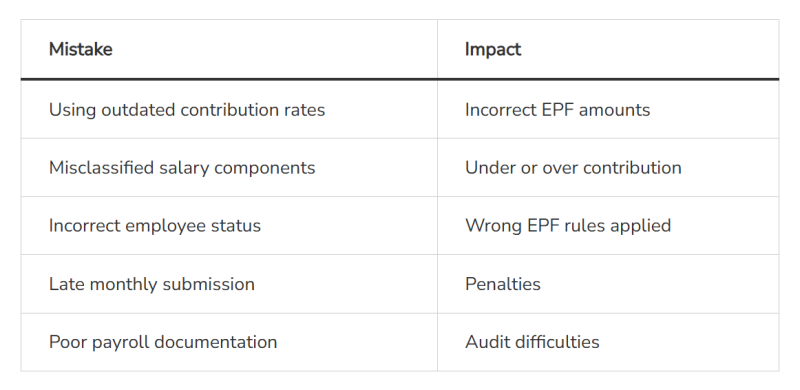

What Are the Most Common EPF Mistakes Employers Make?

Most EPF issues stem from process gaps rather than lack of awareness.

Common EPF Mistakes and Their Impact

With proper controls, these mistakes are largely avoidable.

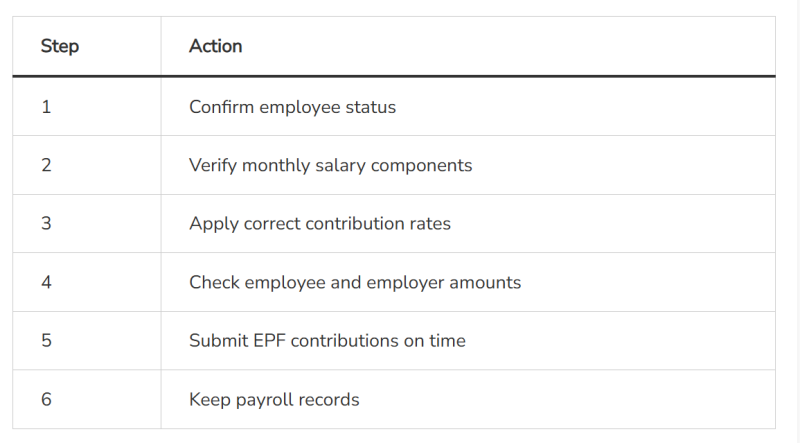

What Should Employers Do Each Month for EPF Compliance?

A consistent monthly routine significantly reduces EPF errors.

Monthly EPF Compliance Checklist

Consistency matters more than complexity when managing EPF compliance.

How Can Employers Reduce EPF Errors More Effectively?

Manual calculations increase error risk, especially when salaries, allowances, or employee details change frequently.

A more structured payroll approach allows employers to:

-

Maintain accurate employee profiles

-

Apply consistent salary classifications

-

Reduce repetitive manual checking

When payroll data is organised and standardised, EPF calculations become more predictable and easier to manage month after month.

Final Thoughts on EPF Contribution in Malaysia

EPF contribution remains a core payroll and compliance responsibility for Malaysian employers. When managed correctly, it supports regulatory compliance, payroll accuracy, and employees’ long-term financial security.

By combining clear payroll processes with structured systems that track salary components and contribution rules accurately, employers can reduce compliance risk, improve operational efficiency, and build greater confidence in their monthly payroll execution.

Frequently Asked Questions

1. Is EPF Contribution Mandatory in Malaysia?

Yes. EPF contribution is mandatory for Malaysian employees under a contract of service. For non-Malaysians, contributions apply based on current EPF regulations.

2. Is EPF Calculated Every Month?

Yes. EPF contributions are calculated and submitted monthly based on the employee’s wages for that month.

3. Can EPF Contribution Rates Change?

Yes. EPF rates may be revised due to policy changes, and employers must apply the latest rates.

4. Does EPF Apply to Part-Time Employees?

Yes. EPF may apply to part-time employees if an employer-employee relationship exists.

5. What Happens If an Employer Pays EPF Late or Incorrectly?

Late payment or incorrect EPF contributions can result in penalties, dividend loss to employees, and enforcement action by EPF. Employers may be charged late payment interest, and repeated non-compliance can trigger audits or legal action.