Deepavali, also known as the Festival of Lights, is a gazetted public holiday in Malaysia, celebrated mainly by the Hindu community.

For employers, this festive season also comes with one important responsibility — ensuring that employees who work during Deepavali are fairly compensated according to the Employment Act 1955.

In this guide, we’ll walk you through how to calculate overtime pay correctly during Deepavali 2025, including public holiday entitlements, formulas, and how an HR system like Pandahrms can help automate the entire process.

When Is Deepavali 2025 in Malaysia?

Deepavali (Diwali) in 2025 falls on Monday, 20 October 2025.

Under Malaysia’s labour law, this is recognized as a national public holiday (except in Sarawak).

So if your business operates during this day — or your employees are required to work — special public holiday pay rules will apply.

What the Law Says About Working on Public Holidays

According to Section 60D of the Employment Act 1955, employees are entitled to paid public holidays each year.

If an employee is required to work on a public holiday, the employer must compensate them with extra pay on top of their normal wages.

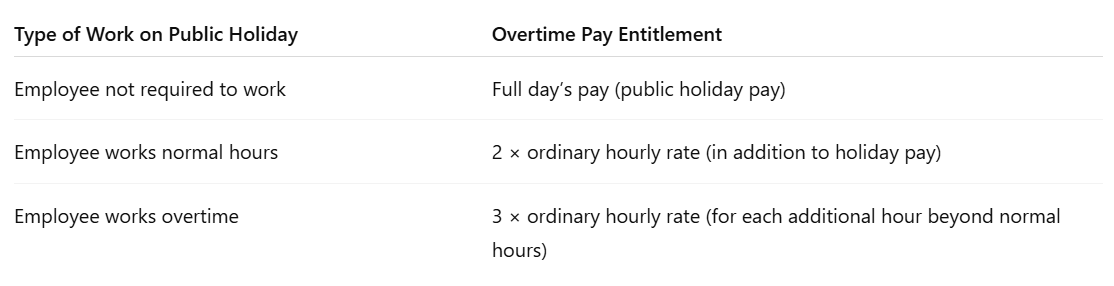

Here’s how it works:

Step-by-Step: How to Calculate Overtime Pay During Deepavali 2025

Let’s go through a simple example.

Example:

-

Employee’s monthly salary: RM2,600

-

Normal working days per month: 26 days

-

Normal working hours per day: 8 hours

-

Employee works 8 hours on Deepavali (normal working day hours)

Step 1: Calculate Ordinary Hourly Rate

Formula:

Monthly salary ÷ 26 days ÷ 8 hours

= RM2,600 ÷ 26 ÷ 8

= RM12.50 per hour

Step 2: Calculate Holiday Pay

Employees are entitled to one day’s pay for the public holiday:

RM100 (RM12.50 × 8 hours)

Step 3: Calculate Work on Public Holiday

If the employee works 8 hours on Deepavali:

2 × RM12.50 × 8 = RM200

✅ Total Pay for Deepavali:

Public Holiday Pay (RM100) + Public Holiday Work Pay (RM200) = RM300 total

If the employee works extra hours (overtime) on top of their 8-hour shift, each additional hour is paid at 3× RM12.50 = RM37.50/hour.

Simplified Overtime Pay Table

Tips to Manage Overtime During Deepavali

-

Plan your manpower schedule early.

Identify who will be working during the public holiday and communicate clearly in advance. -

Track attendance accurately.

Make sure check-ins and work hours are properly recorded to calculate overtime correctly. -

Use a reliable payroll system.

Manual calculation errors during public holidays are common — especially when managing multiple shifts or different pay rates.

How Pandahrms Helps Simplify Overtime Calculations

With Pandahrms, employers no longer need to manually calculate public holiday or overtime pay.

Our system automatically:

✅ Detects public holidays (including Deepavali) in your company calendar

✅ Calculates overtime pay according to Employment Act rules

✅ Integrates time attendance with payroll

✅ Generates payslips instantly with correct holiday pay rates

✅ Ensures full compliance with Malaysian labour laws

Whether you’re managing a small retail team or a large manufacturing workforce, Pandahrms automates your payroll calculations so you can focus on your business — not spreadsheets.

FAQ: Deepavali Overtime Pay in Malaysia

1. Is Deepavali a compulsory paid public holiday?

Yes, Deepavali is one of the gazetted public holidays under Malaysian law (except Sarawak).

2. What if my employee is absent before or after Deepavali?

If the absence is not approved, the employee may lose entitlement to the public holiday pay.

3. Do part-time employees get Deepavali pay?

Yes — if they fall under the Employment Act and work on the public holiday, the same pay rules apply based on their daily or hourly rate.

4. What if Deepavali falls on a rest day or another public holiday?

Employees are entitled to a substitute holiday or another day’s pay, depending on company policy.

5. How can employers ensure accurate pay during festive seasons?

Use a payroll system like Pandahrms that automates public holiday detection, attendance, and overtime pay to eliminate manual errors.

Final Thoughts

Calculating overtime pay during Deepavali doesn’t have to be complicated.

As long as employers follow the Employment Act 1955 and keep accurate records, compliance becomes straightforward.

By using a digital HR system like Pandahrms, you can easily manage festive pay, track attendance, and ensure every employee is paid correctly — even during the busiest time of the year.