The Inland Revenue Board of Malaysia (LHDN) has released a critical update regarding stamp duty requirements for employment contracts, aimed at improving compliance and easing the administrative burden on employers. The changes include exemptions for older contracts, a grace period for contracts signed in 2025, and stricter enforcement measures effective from 2026.

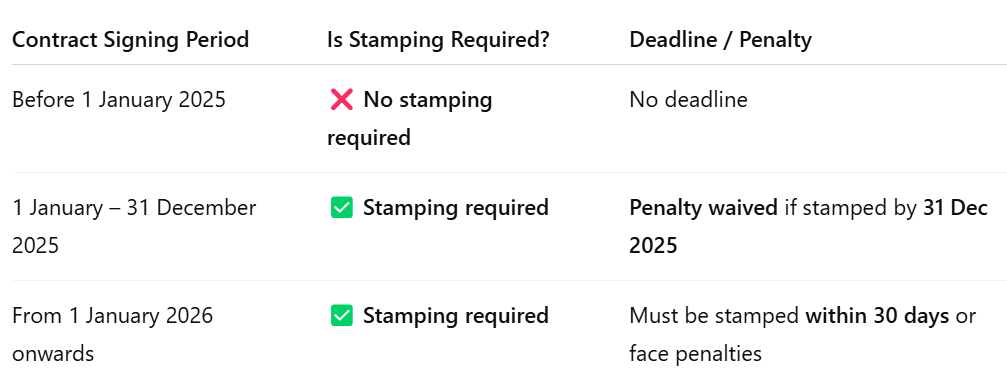

Summary of Stamp Duty Rules for Employment Contracts

To facilitate a smooth transition toward full enforcement, LHDN has adopted a phased implementation approach for stamping employment contracts under the Stamp Act 1949.

Key Details Employers Must Know

1. Contracts Signed Before 1 January 2025

-

Exempted from the RM10 stamp duty.

-

No penalties for late stamping.

-

No further action is required for these contracts.

-

However, stamping can still be done voluntarily to maintain clean HR records.

2. Contracts Signed Between 1 January – 31 December 2025

-

Stamp duty of RM10 per contract is required.

-

Penalty for late stamping is waived, but only if stamped by 31 December 2025.

-

Applies even if the employee has resigned or left the company.

-

Employers are encouraged to take advantage of this grace period to rectify any outstanding documents.

3. Contracts Signed From 1 January 2026 Onwards

-

Must be stamped at RM10 per contract.

-

Mandatory stamping within 30 days of contract execution.

-

Penalties for late stamping:

-

Late by 31 days to 3 months: RM50

-

Late by more than 3 months: RM100

-

-

These penalties are enforceable under the Stamp Act 1949.

Why Is This Update Important?

Although the RM10 employment contract stamp duty has been part of the law for decades, enforcement was previously limited. However, following a nationwide audit revealing high non-compliance, LHDN is ramping up enforcement efforts.

The 2025 Budget announcement also introduced a self-assessment stamping mechanism, making employers directly responsible for ensuring timely and accurate stamping of employment documents.

This update and grace period are intended to:

-

Provide a compliance buffer before penalties are strictly enforced,

-

Encourage employers to regularise historical contracts, and

-

Ensure that all employment relationships are properly documented and formalised.

What Employers Should Do Now

To avoid future issues and penalties, HR departments and business owners should take the following steps:

-

Review all employment contracts and classify them by their signing dates.

-

Stamp all contracts signed in 2025 before 31 December 2025 to benefit from the penalty waiver.

-

Implement internal SOPs to ensure all new contracts from 2026 onward are stamped within 30 days.

-

Keep a stamped copy of each employment contract in your HR files for audit and compliance purposes.

-

Educate HR and administrative teams on these new requirements and ensure they’re prepared for 2026 enforcement.

Need Help Managing Employment Contract Compliance?

At Pandahrms, we understand the challenges of managing HR compliance across multiple processes. That’s why our system includes:

-

Contract tracking features

-

Automated reminders for stamp duty deadlines

-

Secure storage of stamped documents for audits

📲 Get in touch with us today for a personalized demo and discover how we can simplify your HR compliance workflows before the new rules take full effect in 2026.