The Minimum Wages Order 2024 is now in force — ensure compliance and streamline payroll with Pandahrms

As of 1 February 2025, Malaysia’s Minimum Wages Order 2024 [P.U.(A) 376/2024] officially comes into effect, setting the minimum monthly wage at RM1,700 for employers with five or more employees and those involved in professional activities (MASCO Employers). This new wage policy reflects the government’s commitment to raising the standard of living and ensuring fair compensation for all workers — both local and foreign.

For smaller companies with fewer than five employees, a grace period is given — they must comply by 1 August 2025.

Key Highlights of the RM1,700 Minimum Wage Policy

✅ Who Must Comply (Effective 1 Feb 2025):

-

Employers with five or more employees

-

Employers conducting professional activities (as per MASCO 2020), regardless of headcount

🗓️ Who Will Comply Later (Effective 1 Aug 2025):

-

All other employers, including those with fewer than five employees (excluding MASCO employers)

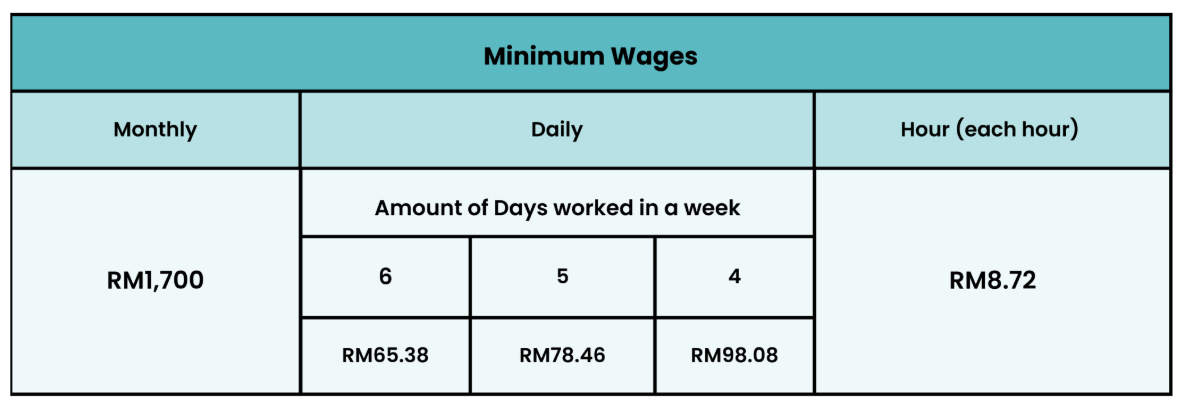

The breakdown of the minimum wage rates by monthly rate, daily rate and hourly rate is as follows:

Exclusions

- Domestic servants are excluded from the Minimum Wages Order 2024.

Who Are Considered MASCO Employers?

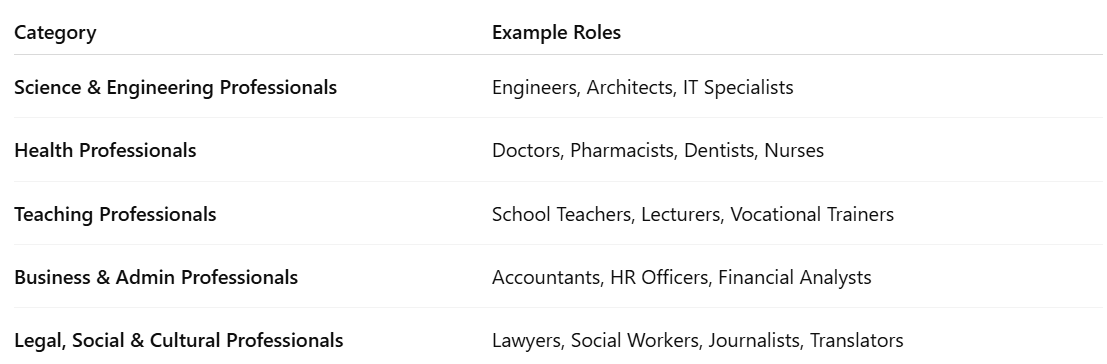

Employers conducting professional activities under MASCO 2020 (Malaysia Standard Classification of Occupations) fall under Major Group 2: Professionals. This includes businesses where core roles involve:

MASCO 2020 – Major Group 2: Professionals

📌 Note: Even if you have fewer than five employees, your company must comply with the RM1,700 minimum wage starting 1 February 2025 if it falls into any of the categories above.

More Than Just a Raise: What’s Behind the RM1,700 Wage?

This wage adjustment was announced by Prime Minister Anwar Ibrahim during Budget 2025 to ensure workers “earn meaningful wages to live more comfortably.” The Malaysian Trades Union Congress (MTUC) emphasized that the new wage must be enforced strictly, warning that without proper enforcement, the policy risks being ineffective.

The new policy is also seen as:

-

A safety net for workers without formal education or specialised skills

-

A call for a more structured and dignified wage system that recognizes education and experience

What Employers Must Do Immediately

As the new wage policy is now in effect, employers must take action to avoid legal and financial penalties:

1. Review Your Employee Categories

Check if your business falls into the current phase (Feb or Aug 2025).

2. Update Payroll Systems

Adjust salary figures and ensure compliance with RM1,700 monthly wage using a reliable HR/payroll system like Pandahrms.

3. Issue Employment Contract Addendums

Employers must document wage adjustments through written addendums to existing employment contracts. These should:

-

Clearly reflect the new wage

-

Include updated daily/hourly wage

- Be signed by both employer and employee

4. Plan Your Budget

Factor in increased labour costs for better financial planning, especially for SMEs.

Frequently Asked Questions (FAQs)

Can Employers Include Allowances in the Minimum Wage Calculation?

According to Section 2 of the Employment Act 1955, wages include basic pay and all cash payments for work done under a contract of service. However, the following are excluded from minimum wage calculations:

-

Accommodation & Utilities: Value of housing, food, fuel, utilities, or approved amenities

-

Employer Contributions: EPF, SOCSO, EIS, or other retirement scheme payments

-

Travel Allowances: Transport-related allowances or travel concessions

-

Expense Reimbursements: Payments covering job-related costs

-

Gratuity Payments: Paid at the end of service or upon retirement

-

Bonuses: Annual or performance-based bonuses

✅ Included in minimum wage calculation:

-

The basic salary agreed in the contract

-

Any fixed cash payment that forms part of the employee’s base compensation

Are Interns Entitled to the Minimum Wage in Malaysia?

Generally, interns are not entitled to the minimum wage as most internships are considered training programs rather than formal employment. However, if an intern is engaged through a formal contract of service, then minimum wage laws may apply. Employers are encouraged to provide a reasonable monthly allowance to cover living expenses even when the minimum wage does not apply.

How Pandahrms Can Help You Stay Compliant

Staying compliant with wage laws doesn’t have to be stressful. With Pandahrms, you can:

-

✅ Automate payroll calculations based on current wage laws

-

✅ Generate addendums and update employee records with ease

-

✅ Track compliance and avoid legal risks

-

✅ Integrate leave, claims, and attendance modules for a complete HR solution

Pandahrms is designed for Malaysian businesses, from growing SMEs to established corporations, offering affordable solutions starting from RM3 per employee/month.

Ready to Simplify Your Payroll and Stay Compliant?

Avoid unnecessary fines and HR headaches — let Pandahrms help you automate payroll updates and manage employee wages with confidence.

Contact us to schedule a personalized demo to see Pandahrms in action!