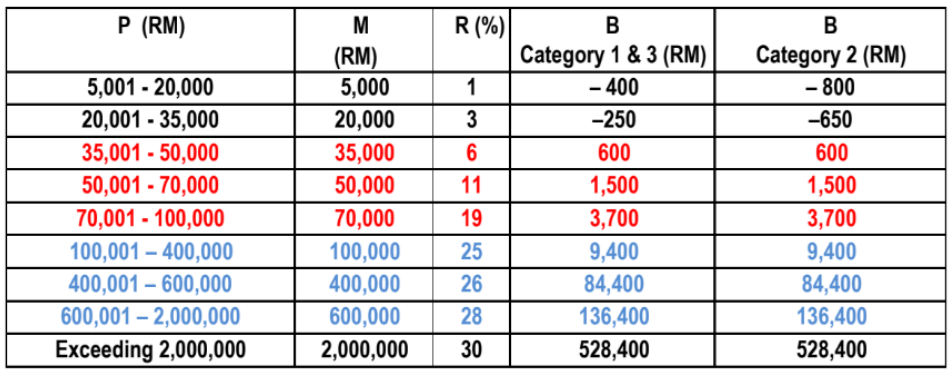

TAX TABLE UPDATE

1. The following chargeable income bands will be reduced by 2%

a. RM 35,001 to RM 50,000

b. RM 50,001 to RM 70,000

c. RM 70,001 to RM 100,000

2. The following chargeable income bands will be increased by between 0.5% to 2%

a. RM 100,001 to RM 250,000 (1%)

b. RM 250,001 to RM 400,000 (0.5%)

c. RM 400,001 to RM 600,000 (1%)

d. RM 600,001 to RM 1,000,000 (2%)

3. The following chargeable income bands will be increased of amount on B from RM 517,450 to RM 528,400

a. > RM 2,000,000

NEW TAX TYPE

1. Added Tax Calculation for Position of C-Suites:

To encourage high value employees to work at Malaysia, a flat tax rate of 15% is given to non-individual citizens who reside in Malaysia and hold the position of C suites in companies that have approved the placement incentive scheme manufacturing operations back to Malaysia.

Encouragement for a flat tax rate of 15% to the C-Suite serving in eligible Electrical and Electronic (E&E) companies is also extended for another 2 years. This incentive extension proposal is effective for applications accepted by MIDA from 1 January 2023 to 31 December 2024.

2. The available tax types in the system are as follows:

a. Normal

b. Returning Expert Program (REP)

c. Knowledge Worker at Specified Region (Iskandar Malaysia)

d. Position of C-Suite (new)

TAX RELIEF UPDATE

1. Medical treatment expenses limit to be increased from RM 8,000 to RM 10,000

a. The scope of relief is expanded to include intervention expenditure for Autism, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay (GDD), Intellectual Disability, Down Syndrome and Specific Learning Disabilities, limited to RM 4,000 as below:

i. Diagnostic assessment certified by a medical practitioner registered with the Malaysian Medical Council

ii. Early intervention and rehabilitation programmers conducted by health profession practitioners registered under the Allied Health Profession Act 2016

2. Expansion of Tax Relief on Life Insurance Expenses

a. The existing relief of RM 3,000 on life insurance premium is expanded to cover voluntary EPF contributions.

3. Extension of tax relief for child care fees paid to a registered child care centers/kindergartens for a child aged 6 years and below

a. To be extended until year of assessment 2024

4. Extension of tax relief on net deposit into the Skim Simpanan Pendidikan Nasional (SSPN)

a. To be extended until year of assessment 2024

TAX TABLE UPDATE

1. The following chargeable income bands will be reduced by 2%

a. RM 35,001 to RM 50,000

b. RM 50,001 to RM 70,000

c. RM 70,001 to RM 100,000

2. The following chargeable income bands will be increased by between 0.5% to 2%

a. RM 100,001 to RM 250,000 (1%)

b. RM 250,001 to RM 400,000 (0.5%)

c. RM 400,001 to RM 600,000 (1%)

d. RM 600,001 to RM 1,000,000 (2%)

3. The following chargeable income bands will be increased of amount on B from RM 517,450 to RM 528,400

a. > RM 2,000,000

NEW TAX TYPE

1. Added Tax Calculation for Position of C-Suites:

To encourage high value employees to work at Malaysia, a flat tax rate of 15% is given to non-individual citizens who reside in Malaysia and hold the position of C suites in companies that have approved the placement incentive scheme manufacturing operations back to Malaysia.

Encouragement for a flat tax rate of 15% to the C-Suite serving in eligible Electrical and Electronic (E&E) companies is also extended for another 2 years. This incentive extension proposal is effective for applications accepted by MIDA from 1 January 2023 to 31 December 2024.

2. The available tax types in the system are as follows:

a. Normal

b. Returning Expert Program (REP)

c. Knowledge Worker at Specified Region (Iskandar Malaysia)

d. Position of C-Suite (new)

TAX RELIEF UPDATE

1. Medical treatment expenses limit to be increased from RM 8,000 to RM 10,000

a. The scope of relief is expanded to include intervention expenditure for Autism, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay (GDD), Intellectual Disability, Down Syndrome and Specific Learning Disabilities, limited to RM 4,000 as below:

i. Diagnostic assessment certified by a medical practitioner registered with the Malaysian Medical Council

ii. Early intervention and rehabilitation programmers conducted by health profession practitioners registered under the Allied Health Profession Act 2016

2. Expansion of Tax Relief on Life Insurance Expenses

a. The existing relief of RM 3,000 on life insurance premium is expanded to cover voluntary EPF contributions.

3. Extension of tax relief for child care fees paid to a registered child care centers/kindergartens for a child aged 6 years and below

a. To be extended until year of assessment 2024

4. Extension of tax relief on net deposit into the Skim Simpanan Pendidikan Nasional (SSPN)

a. To be extended until year of assessment 2024