Managing employee wages accurately is essential for any business in Malaysia. Employers must follow specific legal requirements set out by the Employment Act 1955 to ensure fair treatment of workers, particularly when it comes to calculating basic salary, entitlements on public holidays, rest days, and overtime pay. This guide provides a simplified overview of these components to help HR professionals and employers stay compliant and manage payroll effectively.

1. What is Basic Salary?

Basic salary refers to the fixed amount paid to an employee before any allowances, benefits, or deductions. It forms the foundation for calculating statutory contributions (like EPF and SOCSO) and other entitlements such as overtime pay and annual leave.

📌 Note: Basic salary excludes:

-

Overtime payments

-

Bonuses

-

Incentives

-

Commissions

-

Travel allowances or reimbursements

-

Any other irregular payments

2. What Is a Gazetted Public Holiday in Malaysia?

Section 60D of the Employment Act 1955 defines which holidays employees are entitled to.

- (1) Every employee shall be entitled to a paid holiday at his ordinary rate of pay on the following days in any one calendar year:

- (a) on eleven of the gazetted public holidays, five of which shall be—

- (i) the National Day;

- (ii) the Birthday of the Yang di-Pertuan Agong;

- (iii) the Birthday of the Ruler or the Yang di-Pertua Negeri, as the case may be, of the State in which the employee wholly or mainly works under his contract of service, or the Federal Territory Day, if the employee wholly or mainly works in the Federal Territory;

- (iv) the Workers’ Day; and

- (v) Malaysia Day; and

- (b) on any day appointed as a public holiday for that particular year under section 8 of the Holidays Act 1951.

- (a) on eleven of the gazetted public holidays, five of which shall be—

3. Pay Rules for Public Holidays

-

If the employee does not work:

-

Hourly/daily paid: still entitled to pay for that day

-

Monthly paid: already covered in the fixed salary

-

-

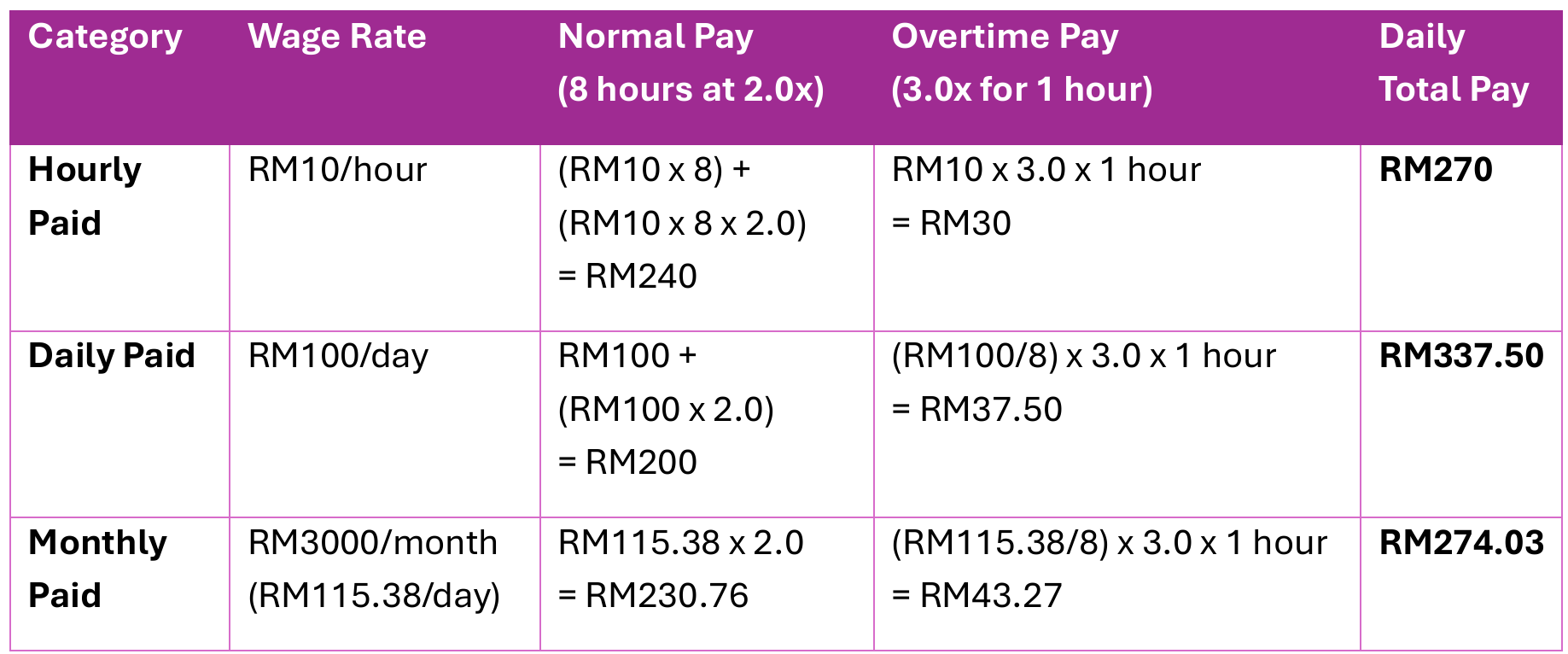

If the employee works on a public holiday:

-

Holiday pay: 2× normal daily wages

-

Overtime (if any): 3× hourly rate

-

4. Rest Days

A rest day is typically a non-working day, usually scheduled after 6 consecutive working days. Employees must be given at least one rest day per week.

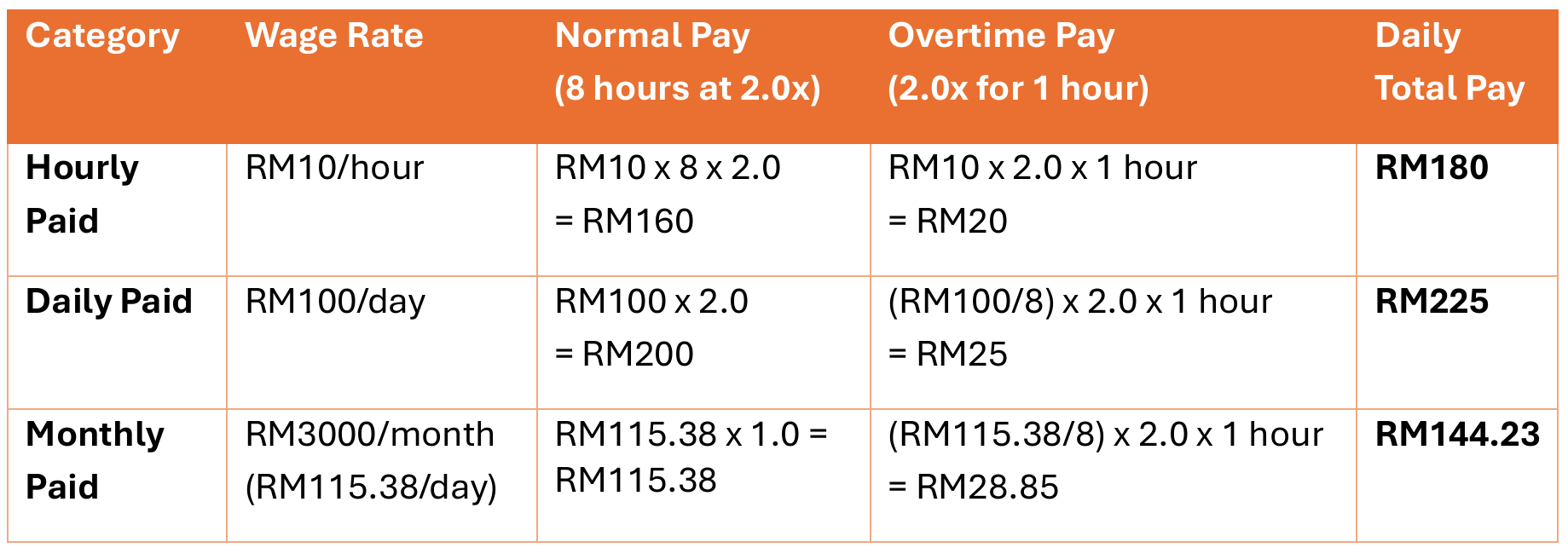

If an employee is requested to work on a rest day:

-

Work ≤ Half day: Paid at 0.5x daily wages

-

Work > Half day but not full day: Paid at 1x daily wages

-

Full-day work: Paid at 2x daily wages

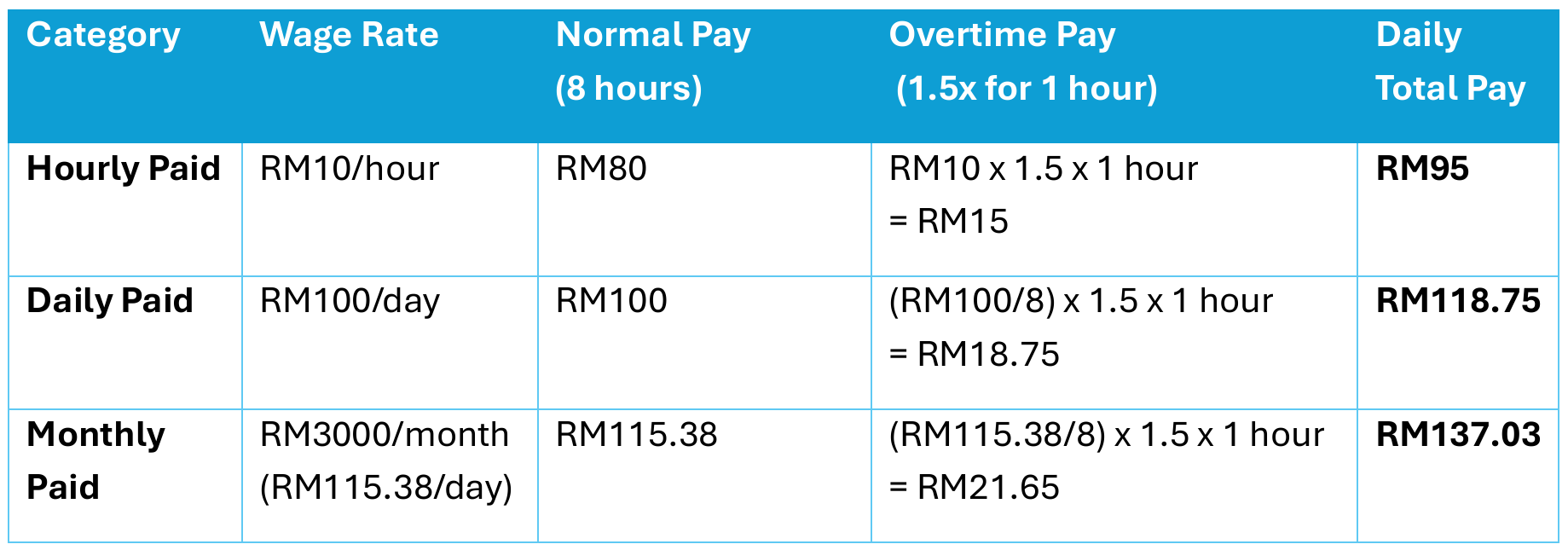

5. Overtime Pay Calculations

Overtime is defined as work done outside of normal working hours, as agreed in the employment contract, usually more than 8 hours per day or 48 hours per week.

The legal overtime rate is calculated as:

-

1.5x hourly rate on normal working days

-

2x hourly rate on rest days

-

3x hourly rate on public holidays

6. How to Calculate Pay

💡Use the following method to derive the hourly rate and compute overtime:

Hourly Rate = Basic Monthly Salary ÷ 26 days ÷ Normal working hours per day

Then apply the relevant multiplier based on the type of day (normal, rest, public holiday).

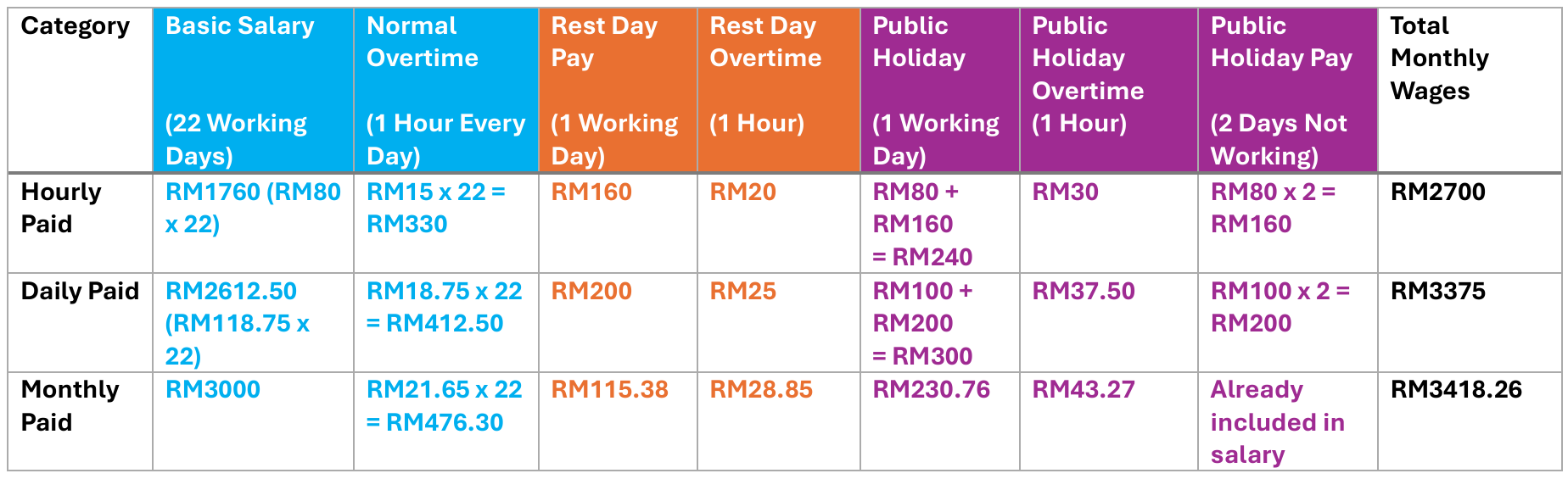

7. Wage Calculation Examples

-

Normal Working Day Calculation

-

Rest Day Calculation

-

Public Holiday Calculation

8. Case Study: Practical Pay Calculation Based on a Real Work Schedule

Let’s look at a real-world example of how monthly wages are calculated with rest day work, public holiday work, and daily overtime.

Scenario:

-

Works 22 days in a month

-

Works on 1 rest day

-

Works on 1 public holiday (1st January 2025)

-

2 public holidays not worked (29th January 2025 & 30th January 2025)

-

Does 1 hour of overtime daily (on 22 working days)

Total Monthly Wages Calculation

This scenario shows how different wage structures affect total earnings, especially with consistent OT, rest day work, and public holiday entitlements.

Conclusion

Understanding and correctly applying Malaysia’s labor guidelines on basic salary, public holidays, rest days, and overtime pay is not just about compliance—it’s also about building trust and fairness in the workplace.

If your HR team still relies on manual calculations, consider upgrading to a digital HRMS to simplify payroll and ensure compliance.

Need help automating your HR processes?

Contact us or schedule a free demo to learn how our system simplifies payroll, leave, and attendance management!